Shares of Trump Media & Technology Group, or DJT, dropped over 6% on Monday, reaching their lowest point since the company went public in March. The reason? A key event called the “lockup period” ended last week. This lockup period is a rule that prevents people from selling their shares of a new company for a set amount of time. In this case, it lasted for six months.

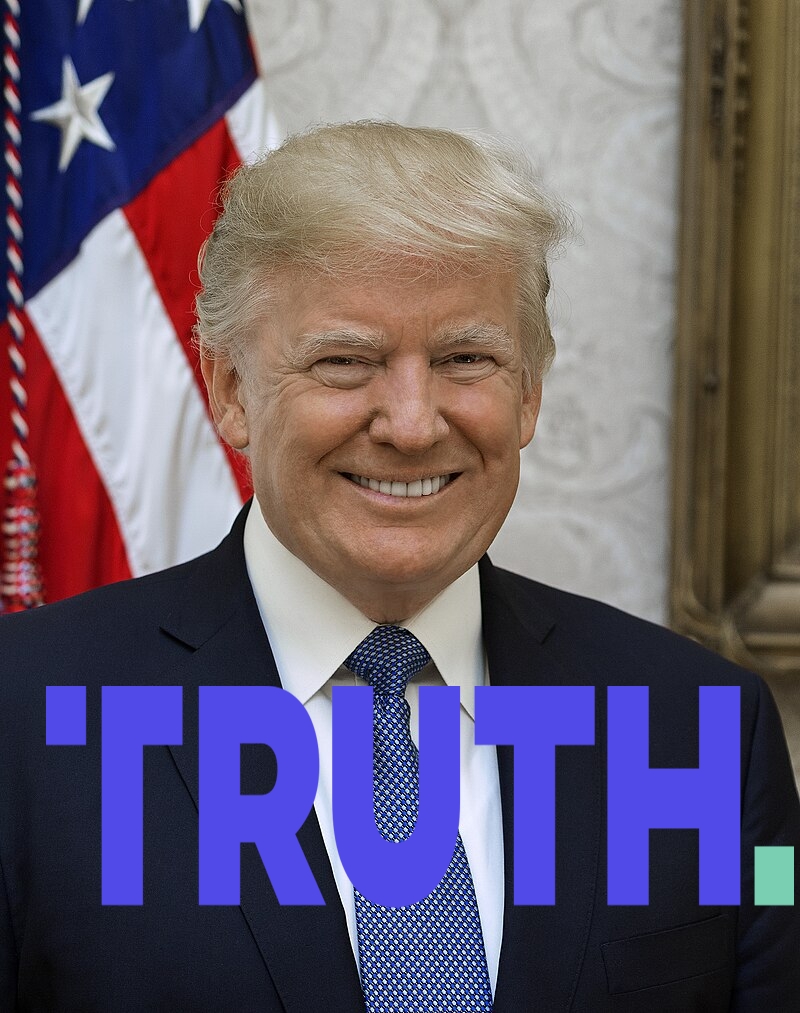

Even though the lockup period ended, Donald Trump, who owns about 60% of the company, has said he won’t be selling his shares. He even mentioned that he uses his media company, which includes his social media platform called Truth Social, to get his message out to the public. He feels that if he sold his shares, it wouldn’t be the same.

Even with Trump keeping his shares, the stock has still fallen. It’s down about 15% since last Thursday and is much lower than its record high of $79 a share. Currently, the company is valued at about $2.5 billion, which means Trump’s portion is worth around $1.5 billion. That’s a big drop from when the company first started, when his stake was valued at over $4.5 billion.

DJT went public after merging with another company called Digital World Acquisition Corp., but the stock’s performance has been rocky. One reason for the ups and downs is news events, such as political debates or legal troubles. For example, when Trump was found guilty of falsifying business records in May, DJT’s stock dropped 5% the next day. In total, since going public, the company’s shares have fallen around 65%.

Truth Social, Trump’s social media platform, was created after he was banned from major apps like Facebook and Twitter following the events of January 6, 2021. Although he’s been allowed back on those platforms, he still uses Truth Social.

The company is also struggling financially. Last quarter, DJT reported a loss of $16.4 million, with less revenue than expected. This raises questions about how well the company can compete with other social media platforms.

In simple terms, Trump’s media company is facing tough times, and its stock has been dropping. Even though Trump has promised not to sell his shares, the future of the company remains uncertain.