The recent turmoil in California’s insurance market has sparked a significant shift in investor sentiment towards insurance stocks. With major insurers scaling back their operations in the state, it may be time to reconsider the weight of insurance stocks in your portfolio. The San Bernardino County Board of Supervisors recently urged state officials to declare a statewide state of emergency to address the insurance crisis. This plea comes in the wake of major insurers like State Farm and Allstate announcing their decision to limit their business activities in California. The Board’s resolution highlights the growing instability in the insurance market and calls for immediate action from California Insurance Commissioner Ricardo Lara, Governor Gavin Newsom, and the State Legislature to stabilize the market.

State Farm, one of the largest insurance providers in the country, has stopped accepting new insurance applications for business and personal property in California. Additionally, its subsidiary, State Farm General, has requested approval for rate increases for homeowners, condo owners, and renters. Other significant players like Allstate and Farmers Insurance have also disclosed plans to reduce their presence in the state.

With the withdrawal of these major insurers, many new and existing homeowners are being forced to seek coverage through California’s FAIR Plan. This plan offers basic hazard coverage but lacks the comprehensive protection provided by private insurers. The FAIR Plan was intended as a temporary safety net, not a permanent solution for the majority of homeowners.

The increased natural disasters and exodus of major insurance companies from California presents a red flag for investors holding insurance stocks. This development could signify deeper underlying issues within the insurance sector that may extend beyond California. The insurance industry in California is facing significant regulatory challenges. If a state of emergency is declared, insurance companies may be prevented from canceling existing policies, leading to potential financial strain. Rate increases requested by companies like State Farm indicate rising operational costs. This trend could squeeze profit margins, affecting the overall financial health of these insurers. The reliance on the FAIR Plan by many homeowners underscores the instability in the private insurance market. This instability may lead to increased volatility in the stock prices of insurance companies with significant exposure to the California market.

The situation in California could be a bellwether for broader issues in the insurance industry. Other states with similar regulatory environments or natural disaster risks might experience similar challenges, amplifying the sector’s risk profile. Given the current scenario, investors should consider rebalancing their holdings. Assessing the proportion of insurance stocks in your portfolio and reducing exposure to companies heavily invested in the California market could be prudent. Exploring opportunities in other sectors or geographical regions with more stable regulatory environments and growth prospects is also advisable. Keeping a close eye on legislative actions and market responses in California is essential. Staying informed about any policy changes that could further impact the insurance sector will help in making timely decisions.

The potential financial strain on insurance companies if they are prevented from canceling existing policies is a significant concern. This situation could lead to increased claims without corresponding premium income, negatively affecting the profitability of these companies. Rising operational costs, as indicated by the requested rate increases, reflect the challenges insurers face in maintaining their margins. These cost pressures could lead to higher premiums for consumers, potentially reducing the affordability and accessibility of insurance coverage. The instability in the private insurance market is evident from the increasing reliance on the FAIR Plan. This trend indicates that private insurers are finding it challenging to operate profitably in the state, which could lead to further market contraction.

The broader implications of this crisis for the insurance industry cannot be ignored. The issues faced by insurers in California could serve as a precursor to similar challenges in other states. Regulatory pressures, coupled with the increasing frequency and severity of natural disasters, could strain the resources of insurance companies nationwide. Investors need to be aware of these risks and consider their impact on the long-term viability of their investments in the insurance sector. Diversifying investments to include sectors with more stable growth prospects can help mitigate these risks. By spreading investments across different industries and regions, investors can reduce their exposure to the specific challenges faced by the insurance sector in California.

Monitoring developments in California is crucial for investors. Legislative actions, regulatory changes, and market responses will provide important signals about the future direction of the insurance industry in the state. Staying informed will enable investors to make strategic adjustments to their portfolios as needed. The unfolding crisis in California’s insurance market serves as a reminder of the importance of regional and sector-specific risk management. Investors should remain vigilant and proactive in assessing the impact of these developments on their investment strategies. By taking a balanced and informed approach, investors can navigate the challenges posed by the current crisis and position their portfolios for long-term stability and growth.

The challenges faced by insurance companies in California highlight the need for investors to reconsider their exposure to the insurance sector. The regulatory and financial pressures in the state are creating an unstable environment for insurers, which could have broader implications for the industry. By carefully assessing the risks and opportunities, investors can make informed decisions to protect their portfolios and achieve their investment objectives.

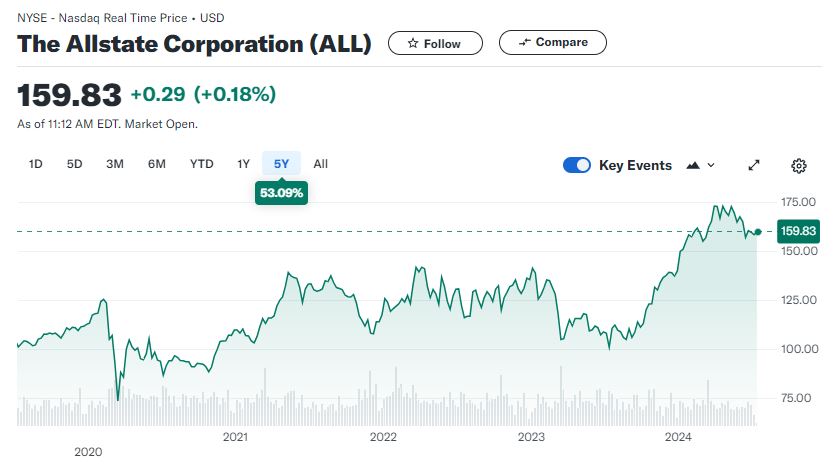

Investors should closely monitor the performance of major publicly traded insurance companies to make informed decisions. As of the latest trading session, State Farm is not publicly traded, but its closest publicly traded competitor, Allstate (ALL), is trading at $115.43 per share. Farmers Insurance is also not publicly traded, but Progressive Corporation (PGR), a significant player in the market, is trading at $128.76 per share. Additionally, Travelers Companies (TRV) is trading at $172.51 per share, and Chubb Limited (CB) is trading at $209.37 per share. Keeping track of these stock prices and market trends will help investors gauge the broader impact of the California insurance crisis on the insurance sector.