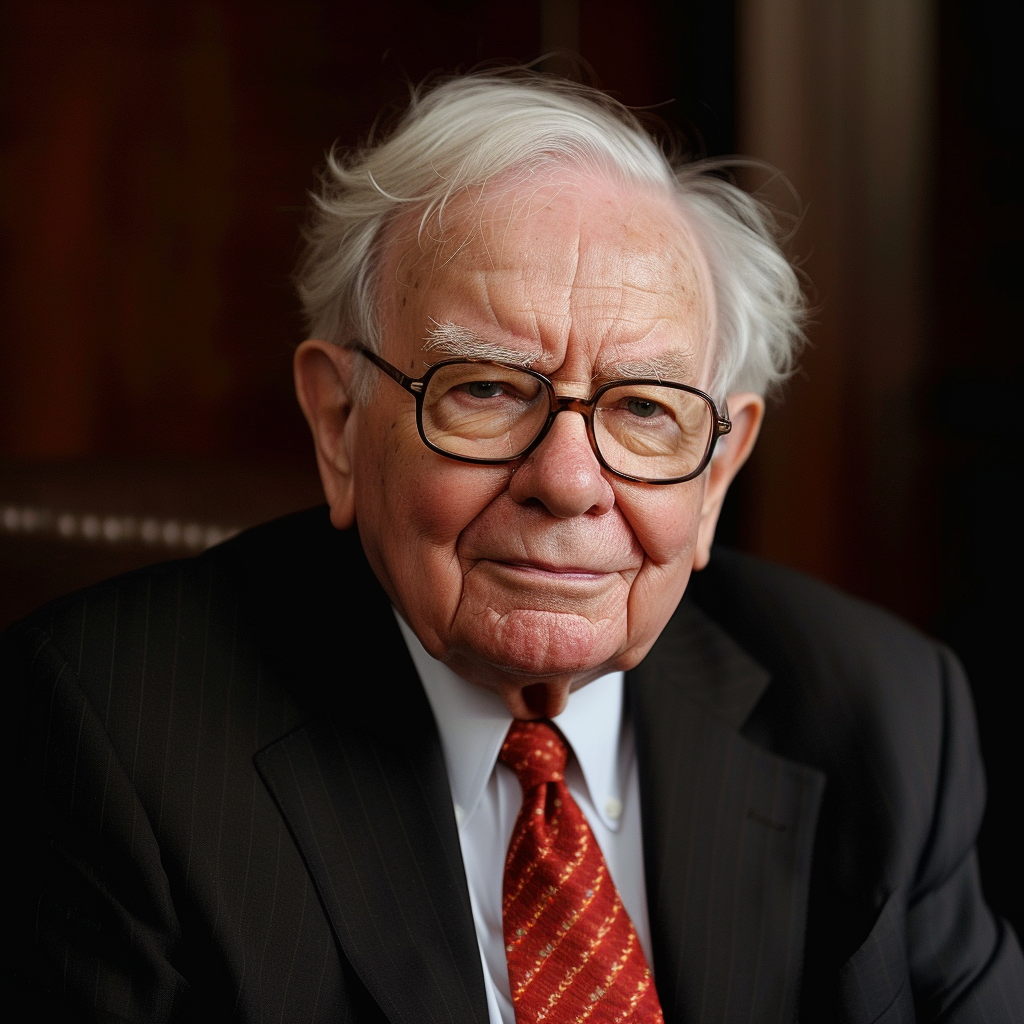

In the modern financial landscape, the concentration of wealth in the hands of a few powerful entities has far-reaching implications. This consolidation not only enables legal market manipulation but also places the financial security of countless individual investors at risk. A stark illustration of this phenomenon can be seen in the recent actions of Warren Buffett’s Berkshire Hathaway.

On Saturday, Berkshire Hathaway’s second-quarter earnings report revealed a significant shift in its investment strategy. Buffett’s conglomerate sold a net $75.5 billion worth of stock and nearly halved its stake in Apple. This massive sell-off sent ripples through the market, underscoring the vulnerability of individual investors, particularly pensioners who have been investing for their entire lives.

When a single hedge fund or conglomerate decides to sell en masse, the consequences can be devastating for smaller investors. The sheer volume of stocks being offloaded can trigger a dramatic drop in share prices, erasing substantial portions of net worth for those who depend on their investments for retirement security. In the case of Berkshire Hathaway’s recent actions, the impact was immediate and severe, demonstrating how the financial decisions of a few can affect the livelihoods of many.

Pensioners, who have meticulously saved and invested over the years, often in blue-chip stocks and trusted companies, find themselves at the mercy of these powerful financial players. A 20% decrease in net worth is not merely a number on a balance sheet; it represents years of hard work, sacrifice, and planning for a secure future. When the market reacts to the selling spree of a conglomerate like Berkshire Hathaway, it is these individual investors who bear the brunt of the fallout.

Legal market manipulation, facilitated by consolidated wealth, skews the playing field. Entities with vast resources can move markets with their decisions, creating a volatile environment for smaller investors. This dynamic raises questions about the fairness and stability of financial markets, where the actions of a select few can disrupt the financial well-being of the many.

Warren Buffett, often regarded as a paragon of prudent investing, exemplifies the power wielded by large conglomerates. His decisions reverberate through the market, influencing not just the prices of individual stocks but the overall sentiment of investors. While Buffett’s strategy may be rooted in sound financial principles, the broader implications for market stability and investor confidence cannot be ignored.

The recent sell-off by Berkshire Hathaway also highlights the importance of transparency and communication in financial markets. When such significant moves are made, timely disclosure and clear reasoning can help mitigate panic and provide a semblance of stability. However, the fundamental issue remains: the concentration of wealth and its capacity to manipulate markets legally.

Addressing this imbalance requires a multifaceted approach. Regulatory frameworks must evolve to ensure that the actions of powerful financial entities do not disproportionately harm smaller investors. Measures to promote greater market transparency and protect the interests of individual investors are crucial. Additionally, fostering a diversified investment landscape can help mitigate the risks associated with concentrated wealth.

For pensioners and individual investors, the key takeaway is the importance of diversification and vigilance. While it is impossible to insulate entirely from the actions of large market players, spreading investments across a range of assets and sectors can provide a buffer against sudden market shifts. Financial education and access to reliable investment advice are also vital components in empowering individual investors to navigate the complexities of modern markets.

The recent actions of Berkshire Hathaway serve as a stark reminder of the power dynamics at play in financial markets. The concentration of wealth in the hands of a few enables legal market manipulation, with significant consequences for individual investors. As pensioners and lifelong investors watch their net worth fluctuate in response to the decisions of powerful conglomerates, the need for regulatory reform, market transparency, and investor protection becomes ever more apparent.