As Hurricane Beryl passes through, the anticipated widespread power outages have not materialized, with fewer people losing power than initially expected. This development could have significant implications for the natural gas market, particularly in Texas, where most homes are powered by natural gas plants.

The crowded natural gas trade, which has seen substantial speculative investment due to forecasts of high demand destruction, might now face an unexpected shift. Initially, investors poured into natural gas futures, anticipating that power outages would lead to demand destruction as damaged homes would be unable to consume natural gas. During Hurricane Harvey, for instance, over 2 million homes lost power for a week, causing a significant drop in natural gas demand and prices.

However, with power grids largely remaining intact after Hurricane Beryl, the expected demand destruction is less severe than projected. This means that the natural gas demand from consumers remains steady, contrary to what traders had anticipated. Current reported outages stand at only 1.7m customers with estimated restoration times of 8-10 hours.

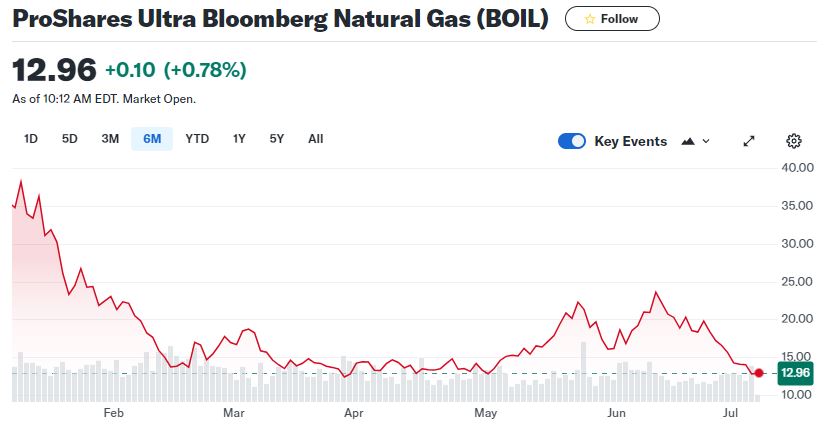

The diminished impact of Hurricane Beryl on power infrastructure could lead to an unwinding of the crowded natural gas trade. Traders who had bet on decreased demand might start to exit their positions, which could, in turn, push natural gas prices higher. This rise would be driven by a sudden shift in market sentiment as speculative positions are closed out and the realized demand remains steady.