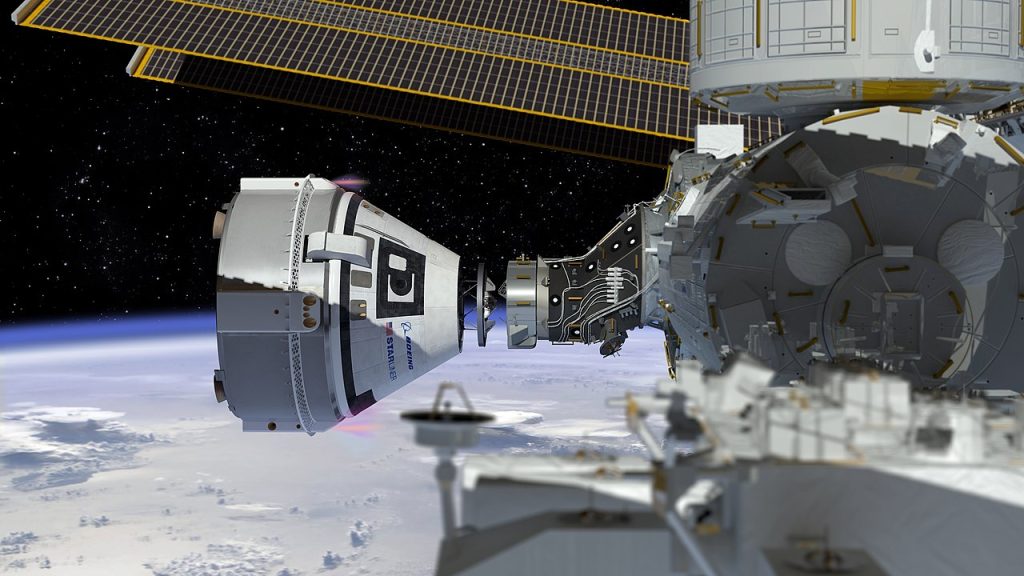

Boeing’s Starliner spacecraft recently returned safely to Earth after a mission to the International Space Station (ISS), but it did so without its crew. NASA astronauts Suni Williams and Butch Wilmore, who traveled to the ISS in June aboard Starliner, remained in orbit due to concerns over the spacecraft’s propulsion system. The decision to delay the astronauts’ return was made after multiple technical issues were identified, including balky thrusters and helium leaks during the spacecraft’s approach to the station.

While the landing itself went smoothly, the problems with the propulsion system are a significant setback for Boeing, which has struggled to establish Starliner as a reliable option for NASA’s Commercial Crew Program. Although Boeing officials maintain that the spacecraft is safe for crewed missions, the decision to leave Williams and Wilmore aboard the ISS underscores ongoing reliability concerns. NASA has now scheduled their return aboard a SpaceX Crew Dragon capsule early next year, casting further doubt on Boeing’s ability to compete with SpaceX in the space transport market.

This mission was supposed to be the final shakedown before Starliner could be certified for regular crewed missions, making it all the more disappointing that Boeing couldn’t deliver a flawless performance. Starliner’s thruster problems were seen as too great a risk for a crewed return, and the astronauts will now remain aboard the ISS for several more months as part of the station’s ongoing crew rotation. The next Starliner mission, dubbed Starliner-1, is slated to be Boeing’s first fully operational mission after certification, but it’s unclear when that flight will take place.

The setbacks with Starliner come at a time when Boeing is facing broader financial and operational challenges. Boeing’s stock has declined significantly in recent months, dropping nearly 40% year-to-date, with a particularly sharp 7% drop in early September. This decline was partly triggered by a Wall Street downgrade that cited delays in ramping up production and concerns over the company’s ability to meet its cash flow target of $10 billion. Analysts now believe this target could be delayed by up to two years.

Adding to the pressure, Boeing may need to raise as much as $30 billion in additional capital for new product development, while the company is already carrying $45 billion in debt. These financial strains have raised concerns among investors about Boeing’s ability to manage both its space and commercial operations effectively. Boeing has been underperforming compared to the S&P 500, with its stock returning negative figures in recent years, while competitors like SpaceX continue to secure major contracts with NASA and the private sector.

SpaceX has emerged as a formidable competitor in the space industry, particularly in the crew transportation segment. NASA’s decision to use SpaceX’s Crew Dragon for the astronauts’ return trip from the ISS highlights the growing reliability gap between SpaceX and Boeing. SpaceX has consistently delivered on its promises, making it NASA’s go-to partner for human spaceflight, while Boeing struggles to resolve its technical issues with Starliner.

The competition between Boeing and SpaceX is not limited to space exploration. Boeing has also faced challenges in its commercial aviation division, most notably with its troubled 737 MAX program. Production delays and safety concerns have continued to plague the company, further eroding investor confidence. The combination of issues in both its space and aviation divisions has left Boeing in a precarious position.

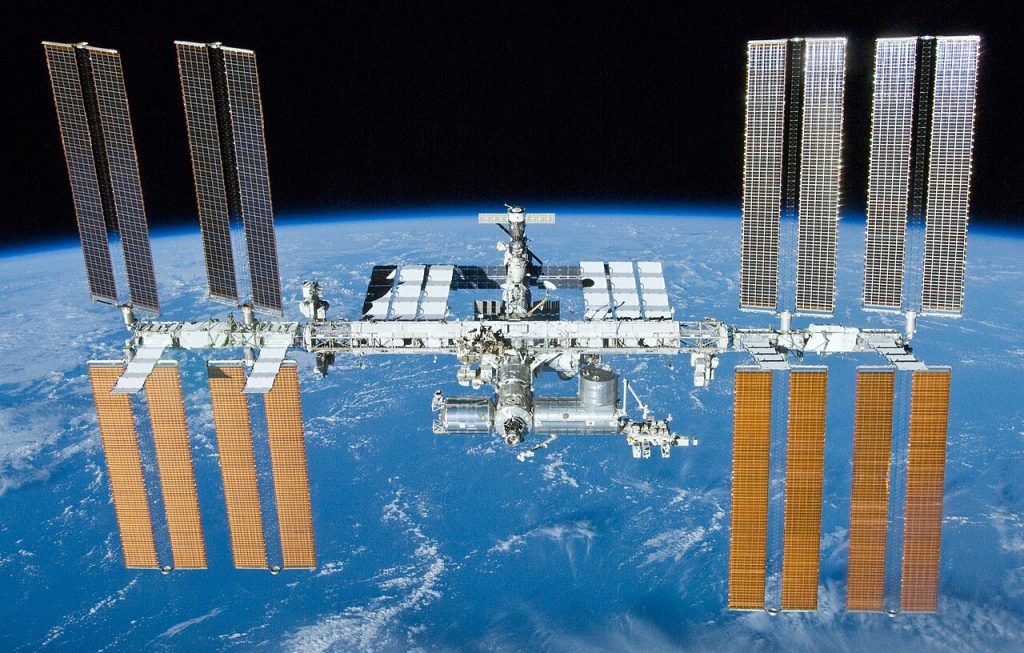

Despite the challenges, Boeing remains a critical player in the aerospace and defense sectors. The company continues to contribute to NASA’s ISS operations and is heavily involved in the development of the Space Launch System (SLS), NASA’s next-generation rocket system. However, with mounting financial pressures and increasing competition from rivals like SpaceX, Boeing’s ability to maintain its leadership role in the industry is under scrutiny.

As Boeing works to recover from these setbacks, it will need to make significant improvements to the Starliner program before NASA can certify the spacecraft for regular crewed missions. The next few months will be crucial for the company as it prepares for the Starliner-1 mission and seeks to restore confidence in both its space and aviation operations. In the meantime, investors and industry experts will be closely watching how Boeing navigates this challenging period.