So after a block buster start to trading, Dutch Bros has underperformed. Is this a company built on smoke and mirrors or are Dutch Bro locations reverse ATMs? The bottom line is do these locations generate significant profit or are investors just throwing good money after bad?

Dutch Bros first location was in Grants Pass Oregon, it has since ballooned to have locations in over 15 states and 401 cities. I have a little first hand knowledge as I happen to know several original franchise owners that started with the company on the ground floor and still remain franchise owners today. None of them were too keen on the company going public and making all new stores in new territories company owned. They all wanted to expand their franchises. Just knowing that made me believe that the stock was likely a very good investment. According to the franchise owners, the stores make money and a lot of it.

Looking through the companies financials a lot of people are focusing on same store sales and their growth. They do not understand what is going on at Dutch Bros. Franchise stores can only open stores in their existing geographic markets and that means those new stores will reduce same store sales as they are competing against their own locations. The fact they they are even still opening stores tells me that the profit margins on the locations must be obscene if they are willing to take customers away from their existing stores just to try to grab a little more market share from their competitors.

Grants Pass is no different than any other small town in America. There are over 15 Dutch Bros Locations in Grants Pass and there are exactly 3 Starbucks. I have yet to see a franchised Dutch Bros stand go out of business or move to a new location. The overhead is low, the customer capacity at the locations is higher than any sit down establishment as they have 2 drive up windows per location. The employees required to service those customers is one of the lowest in the industry. The margins on their products is on par with industry standards in the 300% range. So how can they not be posting record profits quarter after quarter? I will answer that with a question.

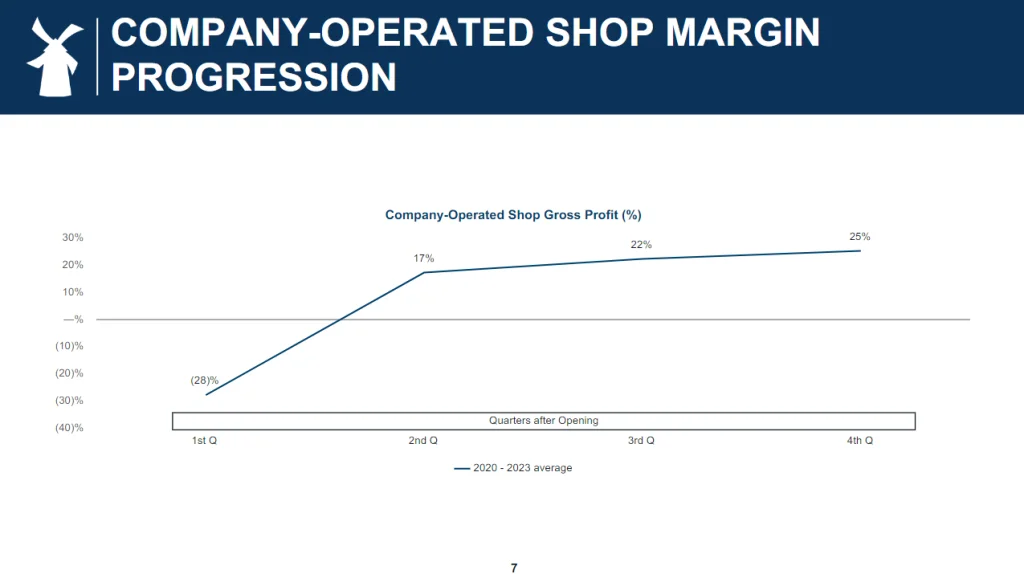

If you could get a guaranteed 25% gross profit return on your capital investment building new locations, how many locations would you build? Would you be willing to dilute existing shareholders if interest rates on the loans you were taking out to chase that 25% return suddenly rose? It is expensive to build new locations, it takes capitol. They could grow slowly of course and use only existing profits to open new stores, but they want to leverage that 25% return as much as possible. If you borrow at 15% interest and make 25% return you net 10% on other peoples money. It makes even more sense if the investors they have understand what they are doing and are willing to keep buying shares to finance new stores. The stock is still trading above it’s IPO price of 23. Some people understand what they are doing.

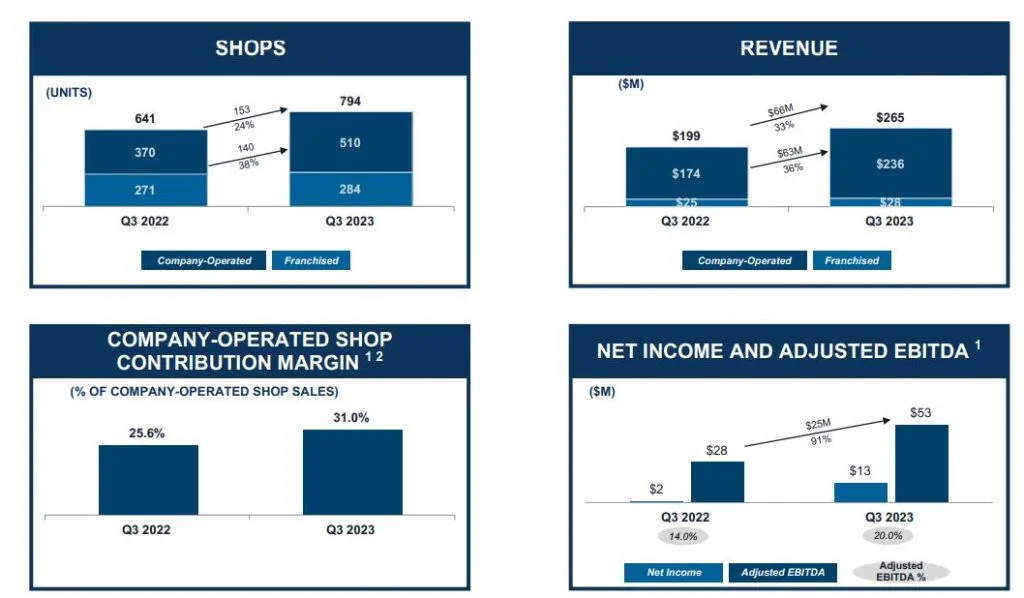

If we look at the growth in revenue it is apparent that they are growing at a very rapid pace. Net income and adjusted EBITDA are also rising. Company operated shop contribution is making up more and more of total margin.

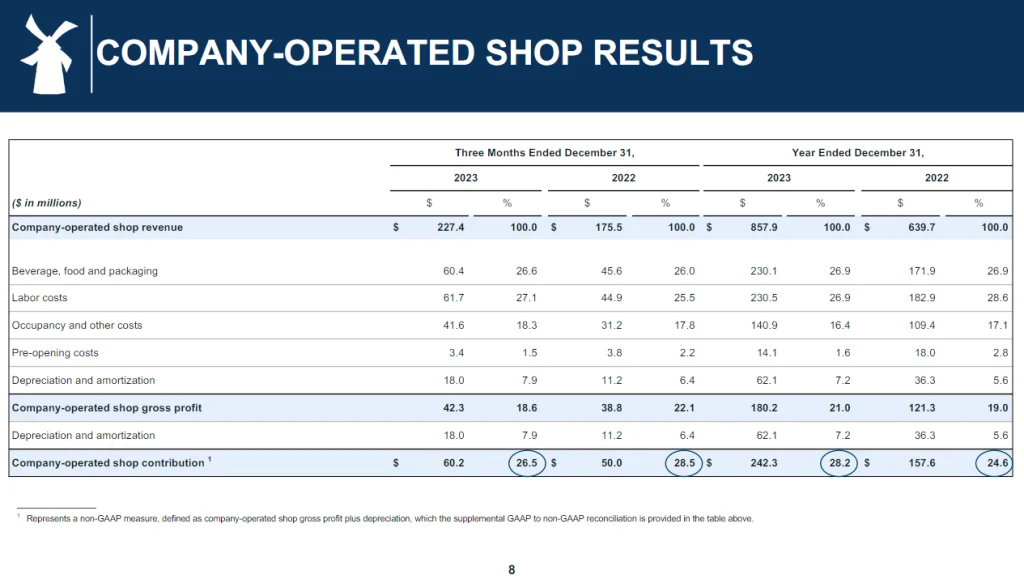

They make a point in their investor relations section of pointing out company operated shop results.

What is going on with Dutch Bros closely resembles what happened with Chipotle. While they were building out over 3200 locations their stock meandered right around or just above IPO price. Then when the market realized they were actually making money the stock went up to a whole different level and never came back down. Based solely on ROI of the franchisees, If I had to choose between opening a Dutch Bros location or a Chipotle, I would open a Dutch Bros hands down. Because it gives a better return and the risk of giving your customers E.coli is a lot less when you don’t deal in vegetables. Of course I can’t become a Dutch Bros franchisee as they don’t allow new franchisees.

Disclaimer/Disclosure: The content on the Site is being provided for information purposes only. The Site does not provide tax, legal, insurance or investment advice, and nothing on the Site should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security or other instrument of investment. Always consult a licensed financial advisor regarding any investment decision. I was not compensated for writing this article by Dutch Bros or a third party agent of theirs. I do not currently have any positions long or short in Dutch Bros. But may take up a position in the future.