Market Eyes on Jackson Hole

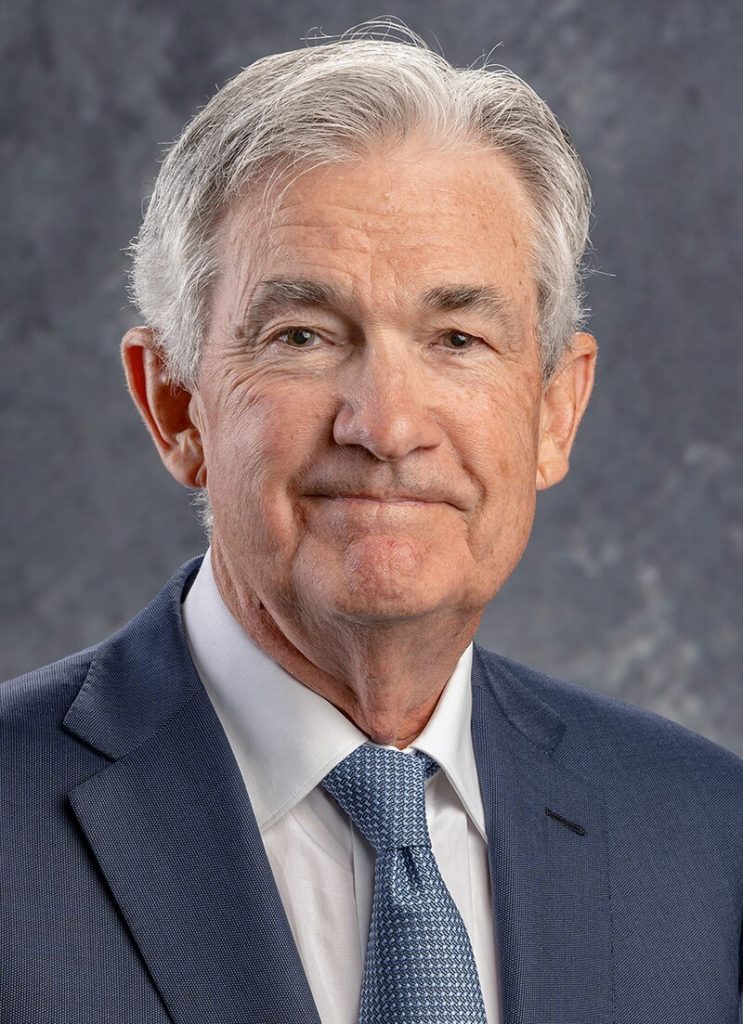

This week, all eyes are on the Federal Reserve’s Jackson Hole Symposium, where Chair Jerome Powell’s speech is expected to shed light on future interest rate decisions. This comes after a strong rebound in U.S. markets, which saw the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average make significant gains. Investors are keen to understand how the Fed will navigate interest rates as inflation cools and economic indicators remain robust.

Stock Market Rebound: A Sign of Confidence?

The recent rally in the stock market, particularly the nearly 4% gain in the S&P 500, reflects growing investor confidence. Positive economic data, including slowing inflation and steady consumer spending, has eased fears of a recession. This resurgence in the market suggests that investors are optimistic about the Fed achieving a “soft landing” where the economy cools without tipping into a downturn.

Jackson Hole Symposium: The Big Questions

The Jackson Hole Symposium is an annual event where central bankers, economists, and policymakers discuss key economic issues. This year’s theme focuses on “Reassessing the Effectiveness of Monetary Policy,” with particular attention on how well traditional tools like interest rates are functioning in today’s economy. Powell’s speech will be crucial in signaling the Fed’s next steps, especially with markets already anticipating rate cuts.

Fed’s Dilemma: To Cut or Not to Cut?

One of the biggest questions surrounding Powell’s upcoming speech is whether the Fed will signal a rate cut in September. With inflation rates finally dropping below 3% and the labor market showing signs of modest weakening, some experts believe the timing is right for the Fed to lower rates. However, there’s also concern that the market’s expectations for substantial cuts might lead to disappointment if Powell doesn’t deliver.

Investor Sentiment: A Balanced Outlook

Investor sentiment has shifted from the extremes of earlier in the month. The Levkovich Index, which measures market sentiment, shows that while optimism is high, it hasn’t reached euphoric levels. This suggests that investors are cautiously optimistic, recognizing the potential for further gains while remaining aware of underlying risks. This balanced sentiment is critical as the market waits for clearer guidance from the Fed.

Corporate Earnings: Retail Giants in Focus

While the Fed’s actions dominate headlines, corporate earnings reports from major retailers like Lowe’s, Target, and Macy’s will also be closely watched. These reports will provide insights into consumer behavior and the health of the retail sector, which is a significant component of the U.S. economy. Strong earnings could further bolster market confidence, while disappointing results might dampen the current optimism.

Economic Indicators: A Quiet Week Ahead

The upcoming week is relatively light on economic data, which means the market’s focus will remain squarely on the Jackson Hole Symposium. However, the data that does come out, such as jobless claims and home sales, will still be scrutinized for signs of economic health. These indicators will help investors gauge whether the economy is on track for the Fed’s desired soft landing.

Global Impact: Watching China

Beyond U.S. borders, the global economic landscape remains uncertain, particularly with China’s economy showing signs of weakness. Declining fixed-asset investments and other challenges in China raise concerns about global growth, which could influence the Fed’s decisions. The interconnectedness of global markets means that developments in one region can have ripple effects worldwide.

Market Expectations: A Delicate Balance

As the week progresses, market expectations will continue to evolve based on Powell’s speech and other developments. Investors are hoping for clarity on the Fed’s strategy, especially regarding interest rates. Any deviation from expected messaging could lead to volatility in the markets, making this a critical week for investors to stay informed and ready to react.

Preparing for the Future

The Jackson Hole Symposium will likely set the tone for the remainder of 2024. With markets poised for potential shifts based on the Fed’s guidance, investors are watching closely for any hints about the future direction of monetary policy. Whether Powell’s speech brings reassurance or sparks uncertainty, the outcomes of this week will have lasting implications for the economy and financial markets.