Just as the feud between DeSantis and Disney seemed to settle, Ron DeSantis initiated a new conflict by targeting banks. In May, Florida Governor Ron DeSantis signed HB 989 into law, aiming to prevent banks from freezing or closing accounts based on non-financial factors such as politics or religion. This move is part of DeSantis’s broader campaign against what he terms “woke” ideology.

DeSantis aims to ensure that banks don’t discriminate against people because of their political or religious beliefs. He says the new law will protect conservative groups and industries like firearms from having their financial services cut off unfairly. The law makes it illegal for banks to deny or cancel services based on a person’s political opinions, lawful business activities, or other non-financial factors. It also allows people in Florida to challenge account cancellations through the state’s Office of Financial Regulation.

However, the U.S. Treasury Department has criticized this law, arguing it could make it easier for criminals to exploit the U.S. financial system. Treasury officials believe banks need to be able to investigate their customers to prevent money laundering and terrorism financing. If banks in Florida can’t do this due to the new law, it could pose a national security risk.

Montana Attorney General Austin Knudsen has also been active on this issue. He led a group of 16 attorneys general in demanding answers from Wells Fargo about their debanking practices. Knudsen is concerned that Wells Fargo is aligning with the Biden administration’s policies and discriminating against Republican candidates and the gun industry. He is investigating Wells Fargo’s decision to close accounts of individuals or organizations it views as a risk.

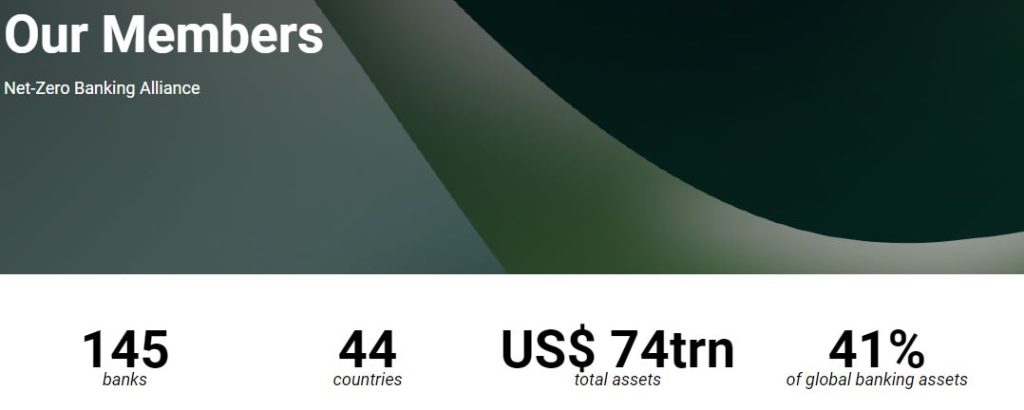

Knudsen points out that Wells Fargo is part of the Net-Zero Banking Alliance (NZBA), which requires banks to align their customers’ greenhouse gas emissions with aggressive targets by 2030. This means Wells Fargo must reduce emissions from its clients in sectors like oil and gas, or else cut off financing to those clients who don’t meet the targets.

Wells Fargo has also committed not to provide new services to certain coal companies and other industries. For example, they canceled a Florida gun dealer’s line of credit, citing “banking guidelines” that exclude certain businesses.

Knudsen and other attorneys general argue that these practices may violate state laws against unfair and deceptive practices. They believe that if banks are acting as “pseudo-governmental gatekeepers,” states need to reconsider how they regulate these large financial institutions.

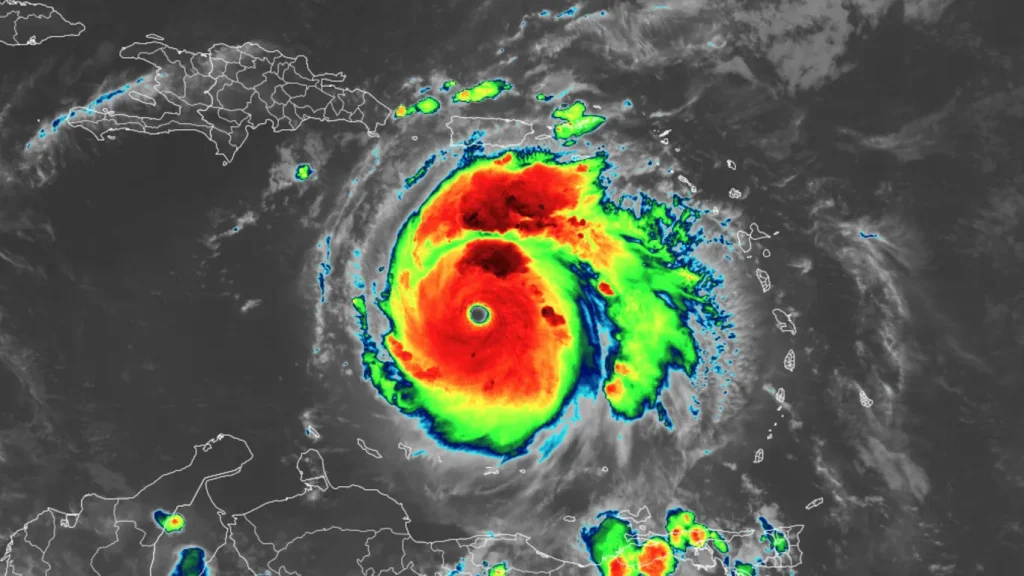

While DeSantis is focused on protecting conservative interests, Florida faces significant environmental threats due to climate change. Experts predict that parts of Florida could be underwater by 2050 due to rising sea levels. Additionally, the state is at high risk for powerful hurricanes, which are expected to become more frequent and intense due to climate change. These natural threats have also led to a steep rise in home insurance costs in Florida, as insurers adjust their rates to account for the increasing risks.

The rising insurance costs have caused a financial crisis of their own, leaving approximately 12% of Florida homes currently uninsured. This means that nearly 1.6 million homes in the state lack insurance coverage because of the unaffordable premiums resulting from the heightened risks associated with climate change.

DeSantis’s new law preventing banks from considering environmental factors could undermine efforts to combat climate change. By targeting banks like Wells Fargo for their environmental policies, DeSantis is putting Florida at greater risk. As climate change accelerates, Florida’s coastal cities are increasingly vulnerable to flooding and storm surges. A Category 5 hurricane, fueled by warmer ocean temperatures, could have devastating effects on the state’s infrastructure and economy.

Wells Fargo and Disney have both seen fluctuations in their stock prices amid these controversies. As of the latest reports, Wells Fargo’s stock has been experiencing volatility due to regulatory scrutiny and environmental commitments. Disney, on the other hand, continues to navigate challenges in the entertainment industry and its ongoing conflicts with DeSantis, which have also impacted its stock performance.

While DeSantis’s new law in Florida aims to protect consumers from discrimination based on their beliefs, it has sparked a debate about the balance between consumer protection and national security. At the same time, his actions against Wells Fargo and other banks trying to address climate change highlight a conflict between political ideology and environmental responsibility. The outcome of these debates could have significant implications for how banks operate and how the U.S. financial system is protected, as well as for Florida’s ability to prepare for and mitigate the impacts of climate change.