Wall Street experienced a significant downturn on Monday, driven by mounting fears of a slowing U.S. economy. The S&P 500 fell by 2.4% in midday trading, marking its worst performance since 2022. The Dow Jones Industrial Average dropped 864 points, or 2.2%, while the Nasdaq composite slid by 2.7%. This decline was part of a global sell-off that began last week, affecting financial markets around the world.

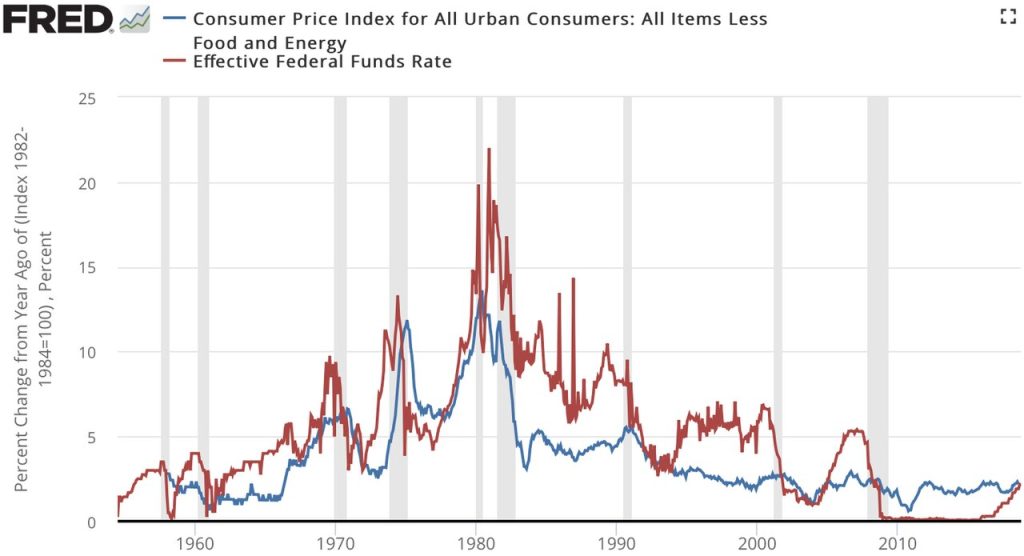

Friday’s report, showing U.S. employers slowed their hiring more than expected, was the latest data point to trigger this sell-off. The weaker-than-anticipated job growth heightened concerns that the Federal Reserve’s prolonged high interest rates might have excessively curbed economic activity. Investors reacted sharply, worried that the central bank’s efforts to control inflation might have gone too far.

The effects of the U.S. economic data were felt globally. Japan’s Nikkei 225 dropped by 12.4% on Monday, its worst day since the Black Monday crash of 1987. This dramatic decline was Tokyo traders’ first chance to react to the disappointing U.S. jobs report. Similarly, South Korea’s Kospi index fell by 8.8%, and European stock markets sank by more than 2%. Bitcoin, often seen as a safe-haven asset, also dropped significantly, falling below $55,000 from over $61,000 on Friday.

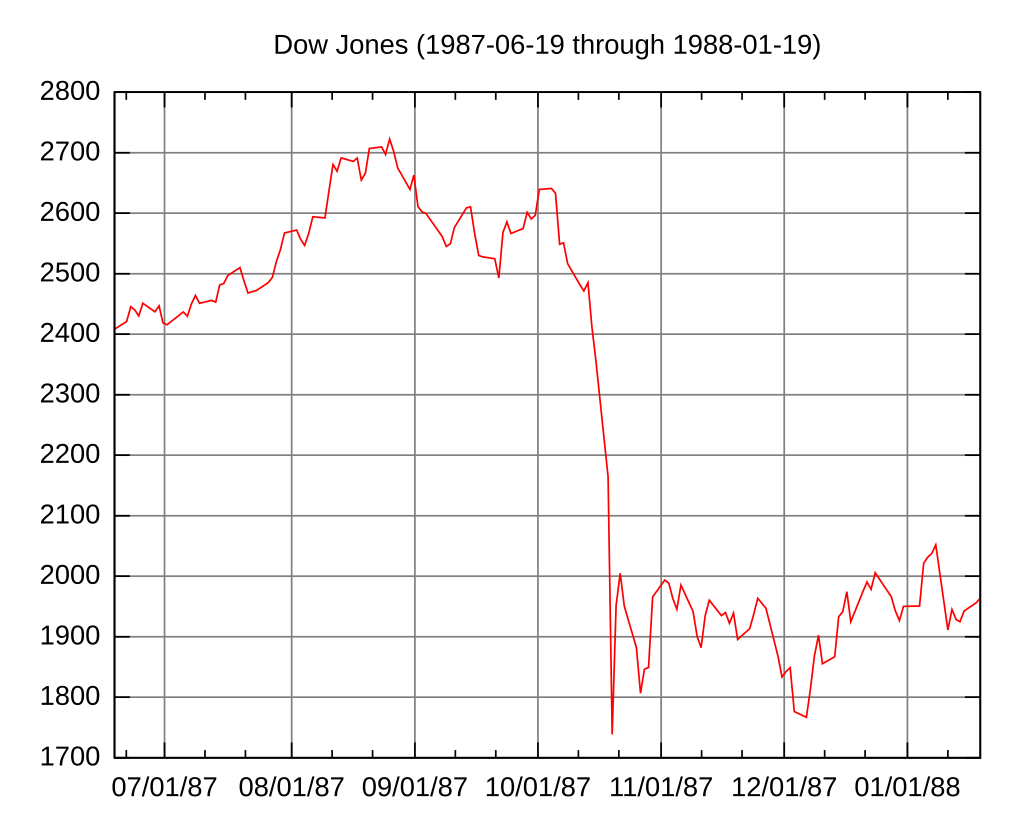

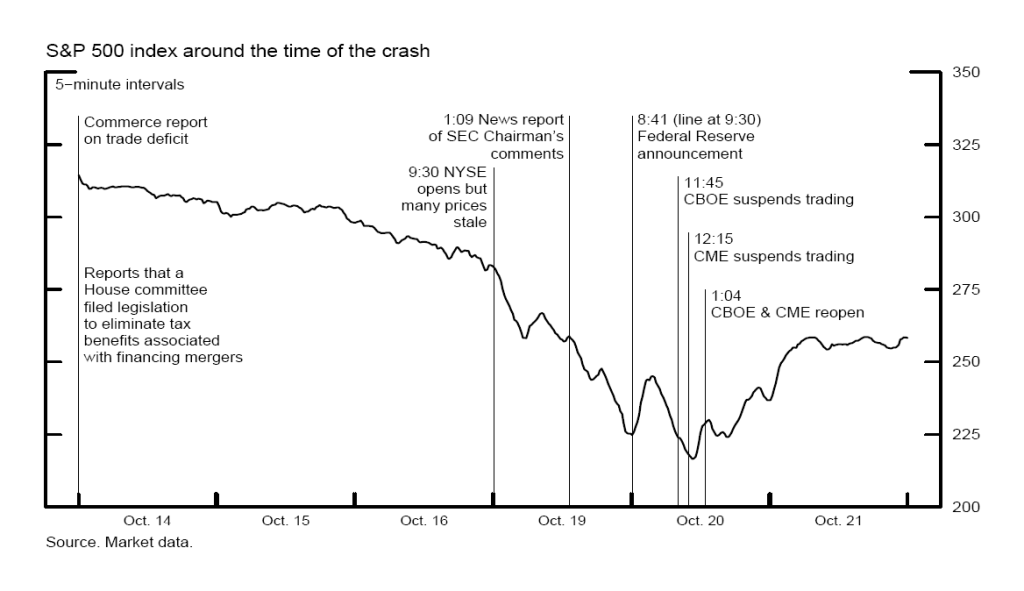

Comparing Monday’s market turmoil to the 1987 crash reveals some striking similarities. On Black Monday in 1987, the Dow Jones Industrial Average fell by 22.6% in a single day, driven by fears of a broader economic downturn. Although Monday’s declines were not as severe, the widespread sell-off and the economic anxieties driving it echo the panic seen 37 years ago. In both instances, unexpected economic data triggered fears that led to significant market losses.

Professional investors noted that technical factors might be amplifying the current market movements. Despite this, the losses remain substantial. The rapid declines across global markets, coupled with sharp drops in Bitcoin and gold, which is traditionally seen as a safe haven, reflect deep-seated investor anxiety. These movements indicate a profound uncertainty about the economic future.

Speculation arose that the Federal Reserve might respond to the market turmoil with an emergency interest rate cut before its next scheduled meeting on September 18. The yield on the two-year Treasury, which closely follows expectations for the Fed’s actions, briefly fell below 3.70% from 3.88% late Friday and from 5% in April. It later recovered to 3.90%, indicating fluctuating expectations about the Fed’s next moves.

Given the current market conditions and recent economic data, several scenarios could unfold. If market conditions worsen, the Federal Reserve might opt for an emergency rate cut to stabilize the economy and restore investor confidence. This could provide a temporary reprieve for the markets. However, ongoing economic data will continue to influence investor sentiment and market volatility.

Markets may remain volatile as investors react to new economic data and potential Fed actions. This could result in further sell-offs or recoveries, depending on the news. The situation remains fluid, and investor reactions are likely to be swift and pronounced based on the latest developments. Right now it looks like the bears have the bulls by the horn.

A gradual recovery could occur if the Federal Reserve manages a soft landing by carefully adjusting interest rates. This would help restore confidence and stabilize the markets over time. However, achieving this balance will be challenging, and the risk of missteps remains. The Fed’s ability to navigate these turbulent waters will be crucial in determining the market’s direction in the coming weeks and months.

The current market turmoil shares similarities with the 1987 crash, driven by unexpected economic data and amplified by global reactions. While the extent of the decline is not as severe, the widespread sell-off and investor fears about the economy are reminiscent of past market panics. The Federal Reserve’s response in the coming days will be crucial in determining the market’s direction, with potential emergency rate cuts being a key factor to watch. Investors and analysts alike will be closely monitoring the Fed’s actions and the broader economic data to gauge what lies ahead for the financial markets. The fed has to balance it’s inflation goals with the stalling economy, it could get interesting.