Tesla shares surged nearly 6.3% on Monday after Morgan Stanley named it the “top pick” in the U.S. automotive industry, replacing Ford. Despite recent political controversies and strategic relocations of Musk’s other ventures, Starlink and SpaceX, to Texas, analysts remain optimistic about Tesla’s future.

Morgan Stanley highlighted Tesla’s energy business, suggesting it could potentially surpass the company’s auto business in value. The focus on climate change-related solutions is likely to attract more investors, reinforcing Tesla’s market dominance.

Tesla’s position in the zero-emission vehicle credit revenue market is also expected to strengthen. The company recognized approximately $2,000 per unit in the second quarter from this revenue stream and may account for up to half of the market’s credit sales, creating a high-margin business that is not yet fully appreciated by the investment community.

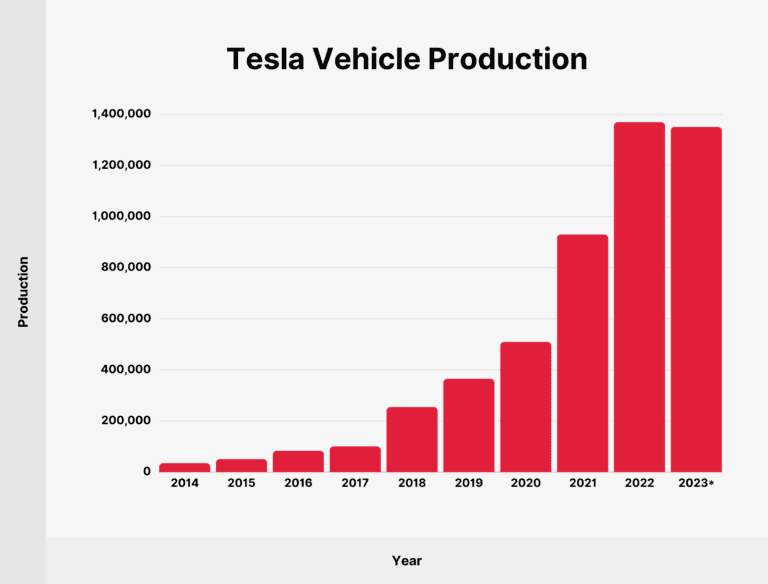

However, Tesla reported its lowest profit margin in over five years last week, missing Wall Street earnings targets for the second quarter.

The company heavily discounted its vehicles to combat declining demand, raising concerns about its profitability. Additionally, analysts pointed out challenges in commercializing autonomous driving technology in China and uncertainties in future EV demand.

Despite these challenges, Morgan Stanley’s endorsement underscores the strength of Tesla’s business model. The company’s ambitious plans for autonomous driving technology and the eagerly awaited robotaxi launch event, delayed to October, continue to generate interest.

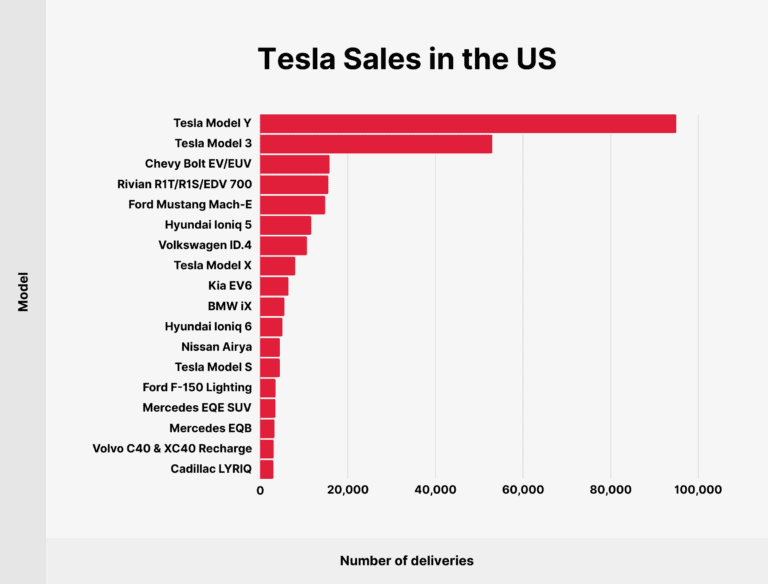

Meanwhile, Ford’s shares dropped nearly 2% on Monday, following a significant 20% decline last week after reporting lower-than-expected second-quarter profits. Ford faces quality-related costs and intense competition in the EV market, struggling to keep pace with industry giants like Tesla.

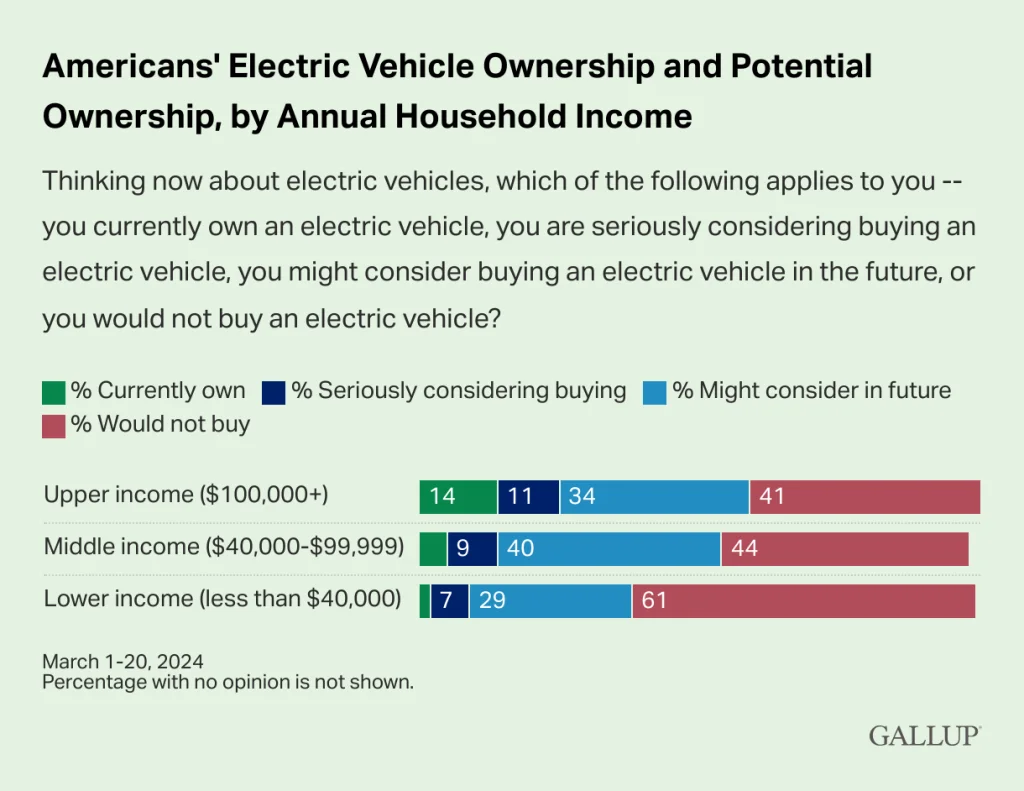

Elon Musk’s decision to move Starlink and SpaceX headquarters from California to Texas has sparked widespread speculation. Many believe this move is a strategic effort to align his brand more closely with Republican values, potentially boosting sales among conservative consumers. Musk’s endorsement of former President Donald Trump and his public announcement of the move in response to California Governor Newsom’s liberal legislative actions have not gone unnoticed.

Data from CivicScience reveals a sharp decline in Tesla’s favorability among Democrats, dropping from 39% in January to just 16% in July. This significant shift in perception reflects a growing reluctance among Democrats to purchase Tesla vehicles due to Musk’s political stance. CivicScience CEO John Dick noted that Democrats, more than Republicans, closely associate Musk’s actions with the Tesla brand.

Despite the political fallout, analysts remain optimistic about Tesla’s market position. The company’s ability to innovate and adapt to changing market dynamics continues to attract investor confidence. Tesla’s strong performance in the automotive sector and its expanding energy business indicate a promising future, reinforcing its status as a market leader.