Chevron Corporation’s recent decision to move its headquarters from San Ramon, California, to Houston, Texas, marks another significant exit of a major corporation from the Golden State. This move, announced on August 2, 2024, is set to unfold over the next five years, with Chevron’s top executives, including Chairman and CEO Mike Wirth, relocating to Houston by the end of the year. The move is seen as part of a broader trend of companies seeking more favorable business environments, particularly in Texas, which has become a magnet for businesses looking to escape California’s stringent regulations and high taxes.

Chevron’s relocation comes at a time when the company is also dealing with a $550 million settlement with the city of Richmond, California. This settlement, announced on August 15, 2024, will see Chevron pay the city in annual installments from July 1, 2025, to June 30, 2035.

The settlement resulted in the Richmond City Council dropping a proposed ballot measure that would have imposed a new tax on Chevron’s Richmond refinery, which processes approximately 250,000 barrels of crude oil per day. The city had argued that Chevron, a long-standing presence in Richmond, should contribute more significantly to the community.

The decision to move to Texas, however, is not without its challenges. One major consequence is the California exit tax, which imposes a one-time tax on businesses and individuals who relocate outside the state. This tax is calculated based on the value of the business or individual’s assets, including property, stocks, and other investments. For Chevron, this could mean a substantial financial burden as it moves its headquarters and potentially other corporate functions out of the state. The exit tax is part of California’s broader wealth tax framework, which seeks to tax the wealth of high-net-worth individuals and businesses that have been residents of the state.

In addition to the exit tax, Chevron and other companies leaving California may face public and governmental scrutiny. Last year, California sued Chevron and other oil companies for allegedly downplaying the effects of climate change, an issue that has become increasingly urgent in the state due to extreme heat waves and rising wildfire incidents.

By moving to Texas, Chevron may hope to distance itself from California’s aggressive environmental regulations, but it could also face criticism for abandoning the state during a critical time in the fight against climate change.

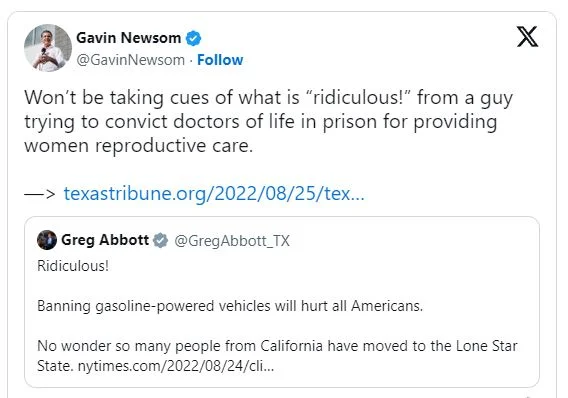

The relocation to Texas is celebrated by Texas Governor Greg Abbott, who welcomed Chevron to what he called its “true home” and emphasized the state’s commitment to the oil and gas industry. Texas, already a leading producer of oil and gas, continues to see surges in crude oil production, even as federal environmental regulations tighten. The state produced more than 2 million barrels of oil last year and supplied 42% of the nation’s oil, according to U.S. Energy Information Administration data. Recently, Abbot and Newsom have been going back and forth on many issues.

For California, Chevron’s departure is a significant loss, not only in terms of economic impact but also in terms of symbolic value. The state has long been a hub for major corporations, particularly in the energy sector, and Chevron’s exit may signal to other businesses that California’s regulatory and tax environment is becoming increasingly inhospitable. This could lead to a broader exodus of companies, particularly those in industries that are heavily regulated by the state.

The move could also have repercussions for Chevron. While Texas offers a more business-friendly environment, the company may find itself dealing with far more natural disasters and power grid issues than it faced in California.

Chevron’s decision to leave California for Texas is a significant development with far-reaching implications. While the move may offer short-term financial and regulatory relief, it also comes with potential long-term risks, both for Chevron and for the broader business community in California. As more companies weigh the costs and benefits of remaining in the state, the outcome of Chevron’s relocation could serve as a bellwether for the future of business in California.