Some people in the United States choose to start collecting Social Security benefits as soon as they are eligible, which can be as early as age 62. Social Security provides a monthly payment to retired workers, and while starting early means a smaller check each month, many still decide to take this option. This decision can be influenced by a variety of factors, including financial needs, health issues, and concerns about the future of Social Security.

Inflation, which causes the prices of everyday items like food and gas to increase over time, is a significant reason why some people start collecting benefits early. When the cost of living rises, having extra money sooner can help cover those expenses, even if it means receiving less each month for the rest of their lives. For some, the immediate need for money outweighs the benefit of waiting for a larger check.

Another reason people might claim Social Security early is due to unexpected life changes. Health problems or losing a job can force someone to retire earlier than they planned. In these situations, having a source of income becomes crucial, and Social Security can provide that, even if it’s at a reduced rate. Additionally, some people find themselves needing to care for a sick family member, which can also lead to an early retirement.

There are also concerns about the future of the Social Security program itself. Some people worry that Social Security might run out of money or change in ways that could reduce their benefits in the future. Because of these fears, they might decide to start collecting their benefits as soon as possible, even if it means getting less money each month.

However, starting Social Security early comes with trade-offs. While you get money sooner, the monthly payments are significantly lower compared to waiting until your full retirement age, which is usually between 66 and 67 years old. The longer you wait, the larger your monthly payments will be. For example, someone who starts collecting at 62 might receive $1,247 per month, while waiting until 67 could result in a payment of $1,782.

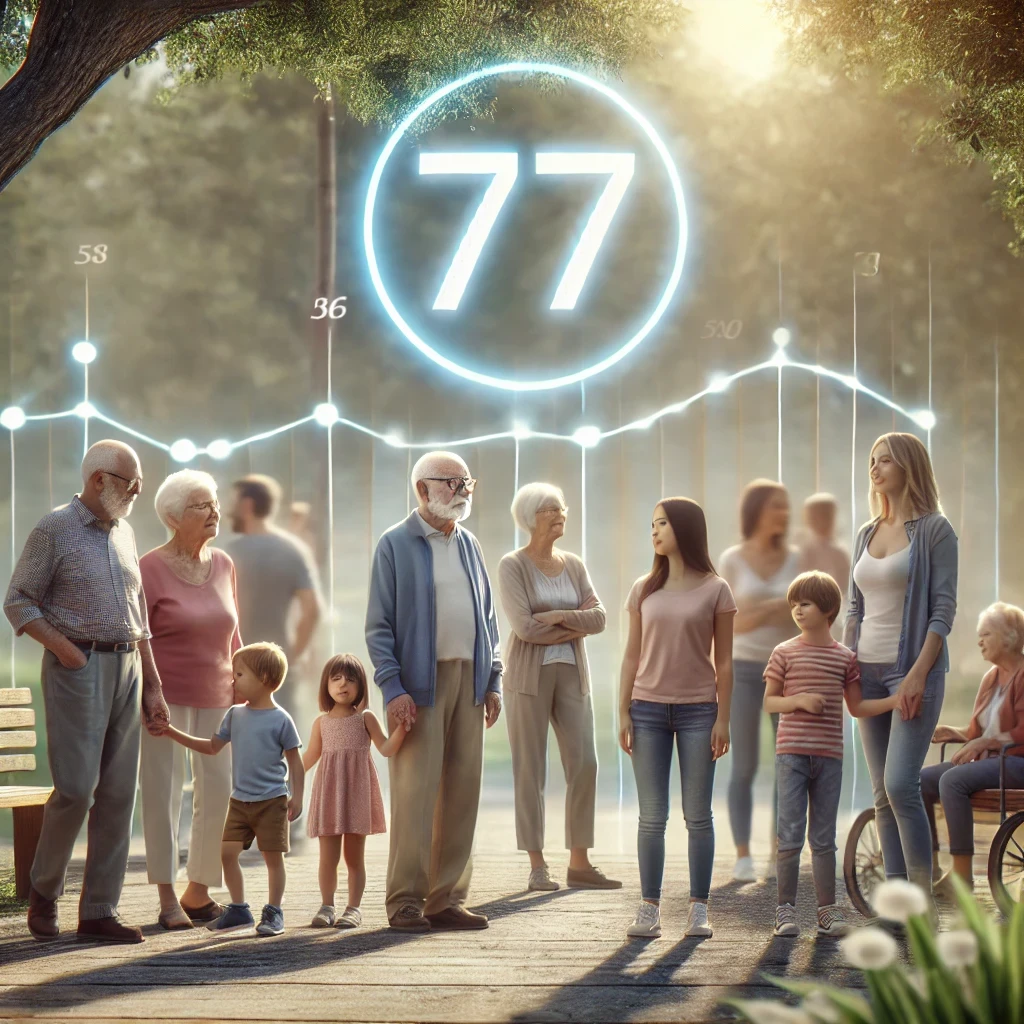

The decision to start early or wait depends on how long you think you will live. Financial planners often talk about a “break-even” point, which is the age at which the total amount of money you’ve received by starting early equals what you would have gotten by waiting. This point usually happens around age 80. Considering that the average life expectancy in the United States is about 77 years, many people may never reach that break-even point, making early collection more appealing.

Taxes are another important consideration. If you start collecting Social Security while you’re still working, some of your benefits might be taxed. This means that part of the money you receive from Social Security could be taken away as taxes, depending on how much other income you have. For instance, if your income is above a certain level, up to 85% of your Social Security benefits might be subject to taxes.

Deciding when to start collecting Social Security is a complex choice and depends on your unique situation. For some, getting money earlier is necessary due to health, job loss, or other financial pressures. Others may decide to wait in order to receive higher payments later on. It’s important to weigh the pros and cons and consider how long you expect to live and what your financial needs might be in the future. If you are active and in good health with a family history of living well into your 90’s waiting might be the answer.

Because everyone’s situation is different, it’s a good idea to talk to a financial advisor before making a decision. An advisor can help you understand the implications of starting Social Security early and guide you in planning for a comfortable retirement. By considering all the factors, including your expected lifespan, you can make an informed choice that best suits your needs and future plans.