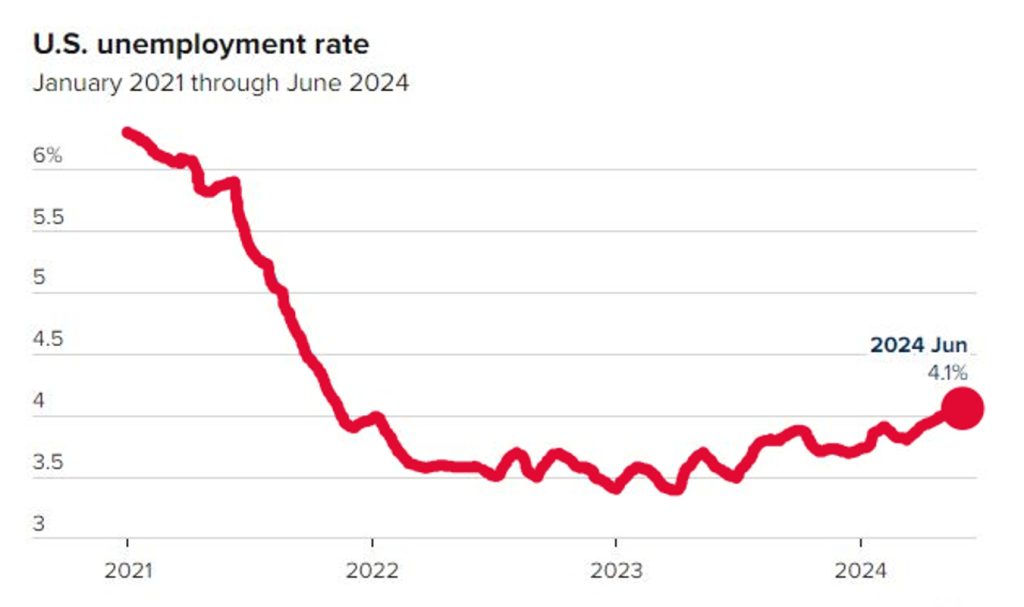

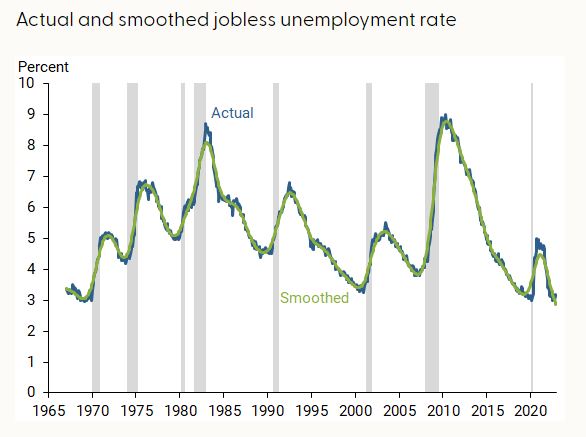

New signs of a cooling labor market are stoking fears that the Federal Reserve may have waited too long to start lowering interest rates. Data from the Bureau of Labor Statistics released Friday showed the US economy added 114,000 nonfarm payroll jobs in July, fewer than the 175,000 expected by economists. The unemployment rate rose to 4.3% — its highest level since October 2021.

The new numbers reinforced concerns among some Fed watchers that the central bank should have decided at a meeting this week to lower rates for the first time in four years — to get ahead of a slowing US economy before it tips into a recession.

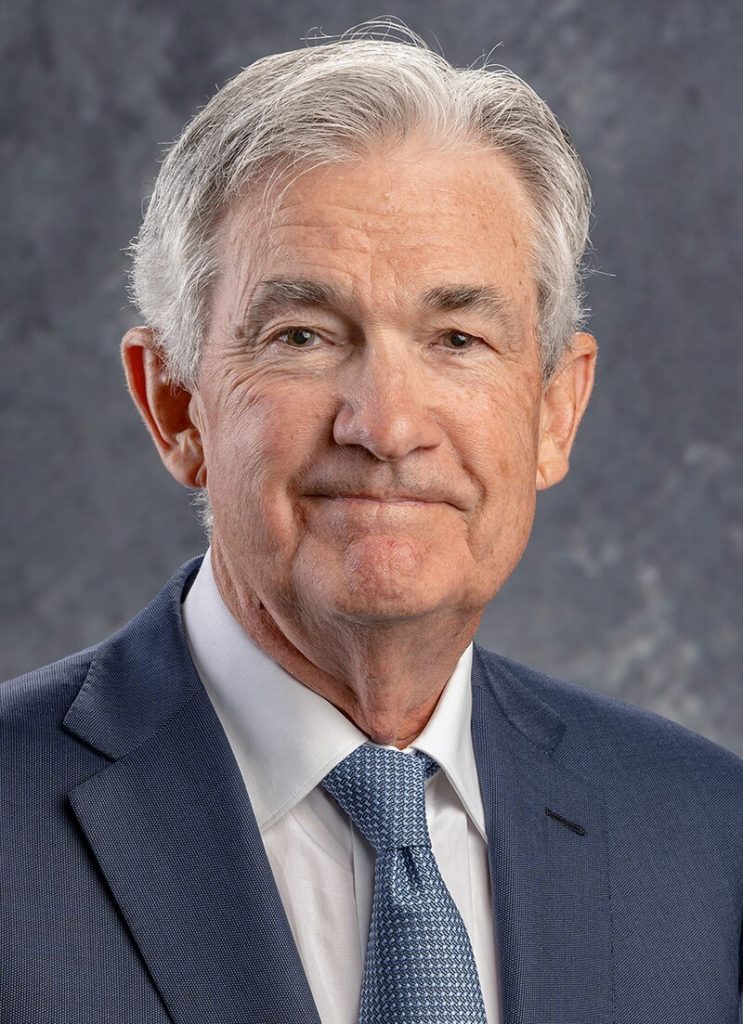

Fed Chair Jerome Powell said Wednesday that a cut in September was “on the table” as long as the data supported it, while acknowledging that there was a discussion at this week’s meeting about whether to move in July. Policymakers decided instead to keep rates at a 23-year high.

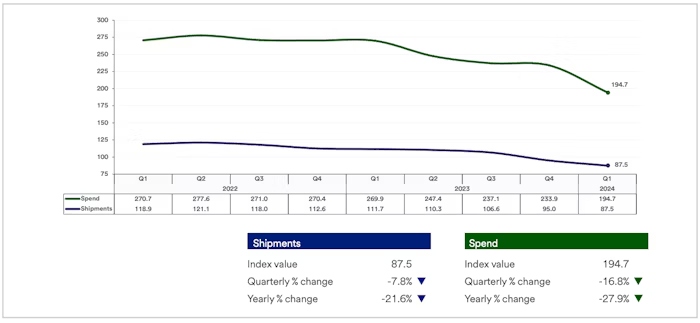

Bobby Holland, director of freight business analytics at U.S. Bank, noted that despite hopes for a freight market turnaround at the beginning of the year, data showed continued challenges. “Nationally, this was the eighth straight quarter of year-over-year volume decreases and the fifth straight with a drop in spending,” Holland said.

Bob Castello, senior vice president and chief economist at the American Trucking Associations, added that freight shipping capacity continued to outpace available freight volume. “Spending fell disproportionately to the drop in volume, which suggests downward rates pressure to start the year,” he said.

The sector has been mired in headwinds since the pandemic, as strong COVID goods demand declined over the years that followed. In the wake of falling consumption, the industry was left with an oversupply of trucks and sliding sales.

The latest example of the industry’s struggles came when S&P Global Ratings cut to negative its outlook on Accuride, a commercial-truck-parts manufacturer. The agency cited weak sales and negative free operating cash flow as reasons the company is at risk of default next year. “Freight market conditions have remained much weaker than our previous expectations and underpin the reduction in our earnings and cash flow estimates for the company,” the report said.

JB Hunt, a leading trucking firm, was one of the first to warn of this “freight recession” in 2023. Its problems persisted into 2024, when the firm posted both a profit and sales miss in the first quarter. Its stock is now down 21.3% year-to-date.

Looking forward, investors should be hesitant to bet on a rebound in the second half of 2024, given that the freight industry is closely aligned with goods buying, S&P analysts wrote separately last month. While consumption averaged 2.7% in the first two quarters, it’s now forecast to slow to a 2% annual growth rate, they said. In part, interest rates will drive the slowdown and will also bear on the trucking sector.

In light of these developments, it is evident that the Federal Reserve may have misjudged the timing and severity of economic shifts, particularly within the truck freight shipping industry. The ongoing slowdown in this sector underscores the broader economic malaise that could have been mitigated by more timely and aggressive monetary policy adjustments.