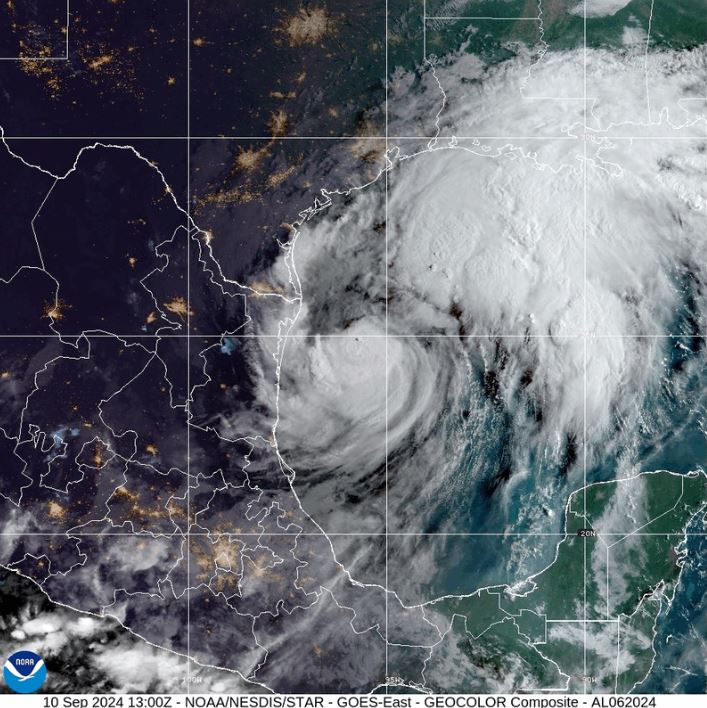

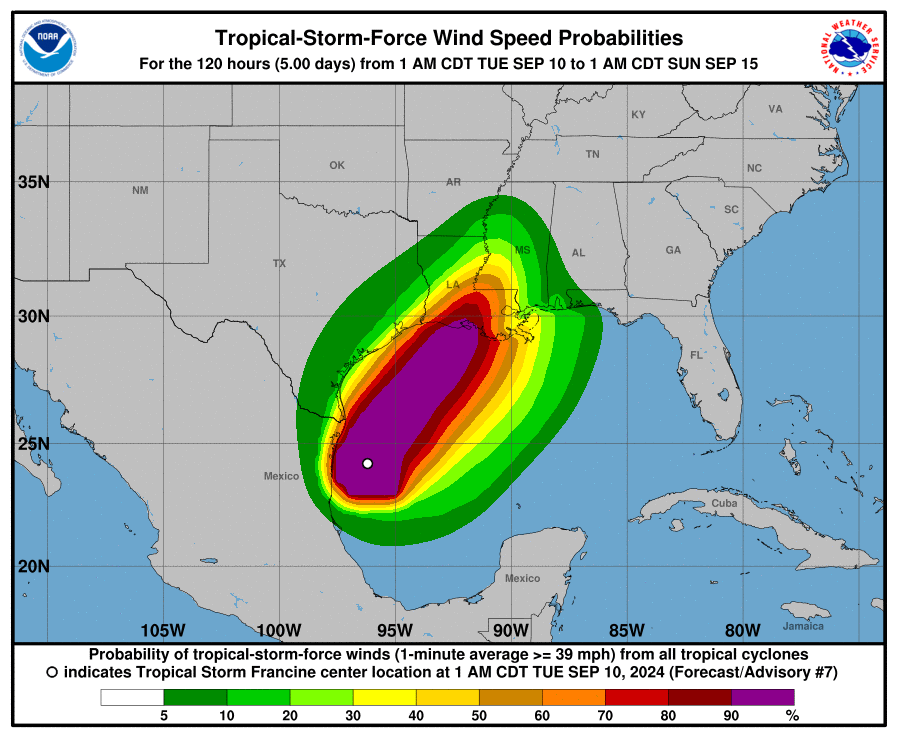

Hurricane Francien’s Path and Potential Impact

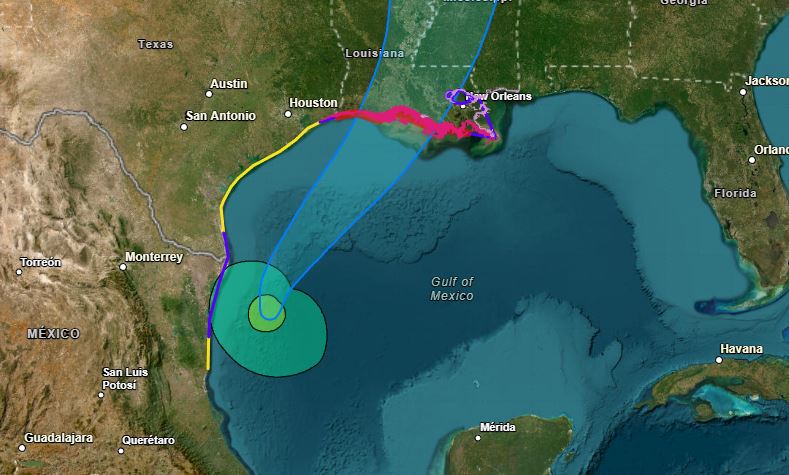

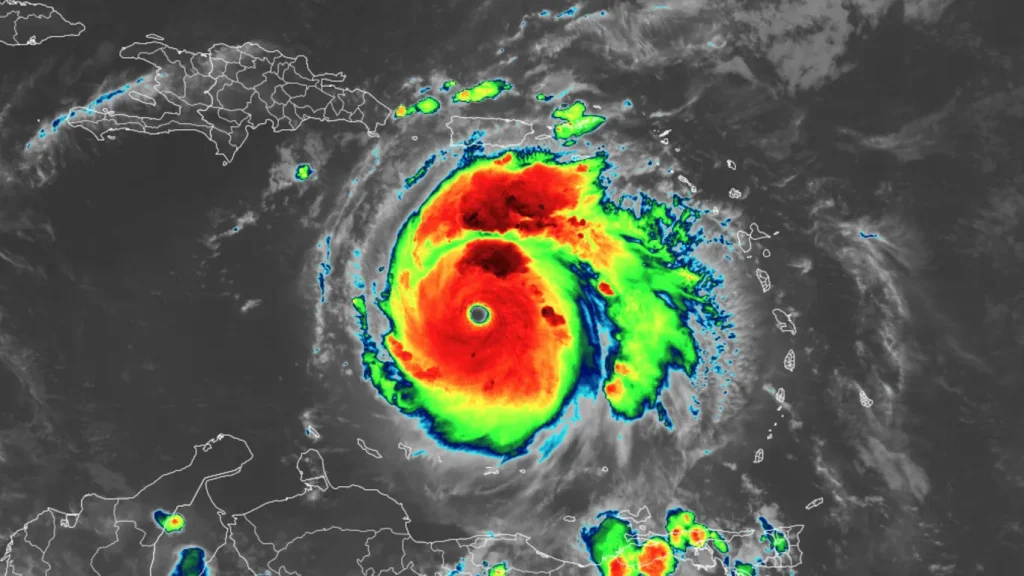

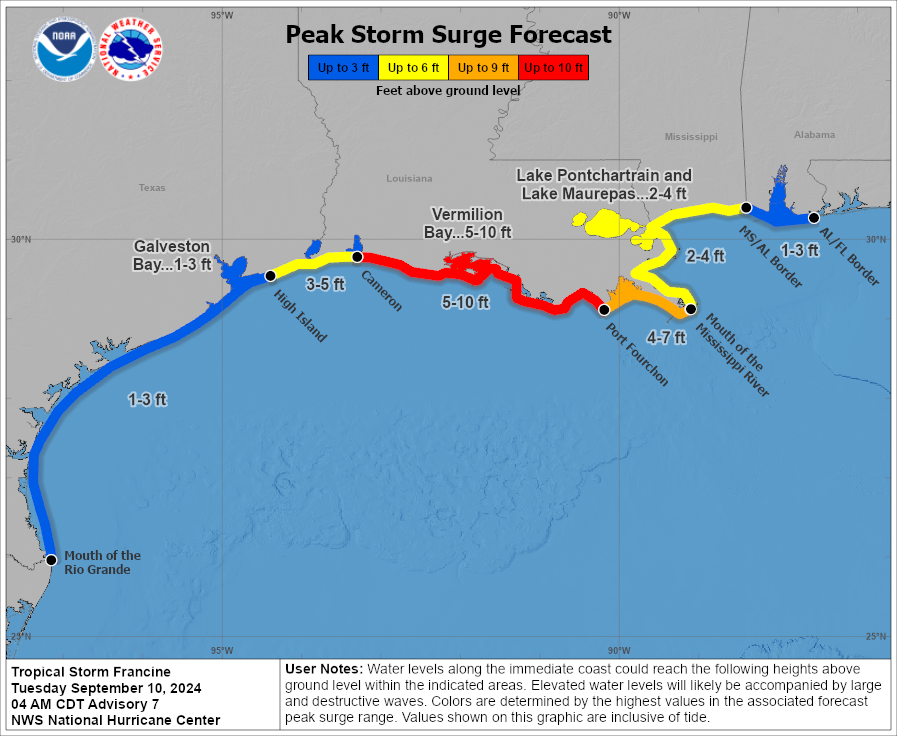

Hurricane Francien, currently centered in the Gulf of Mexico, is forecasted to make landfall in Louisiana by Wednesday, September 11. With maximum sustained winds expected to exceed 75 mph, the storm is projected to bring heavy rainfall, dangerous storm surges, and potential flooding from Texas to Mississippi.

Authorities are urging coastal residents to prepare for potential evacuation, while energy markets are paying close attention to the possible disruptions Hurricane Francien might bring.

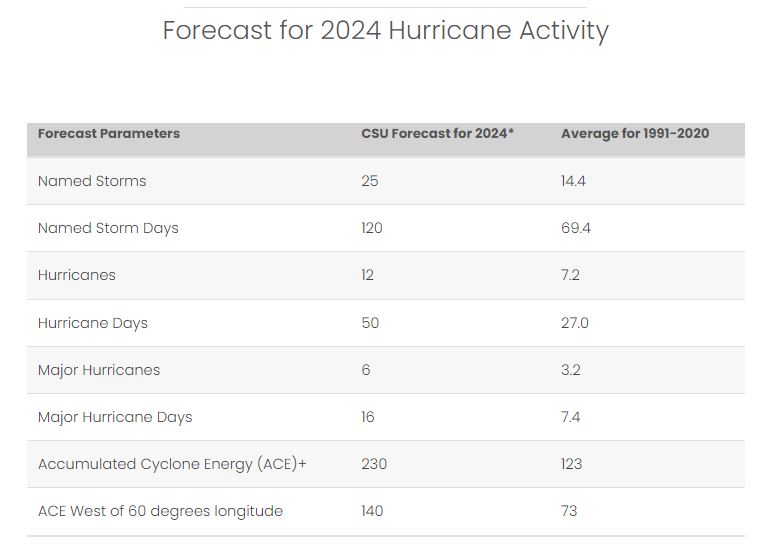

Historically, hurricanes in the Gulf of Mexico had significant implications for the natural gas industry, particularly when storms forced evacuations of offshore production platforms. Hurricanes Rita and Katrina in 2005, for example, caused substantial damage to production facilities, leading to a spike in natural gas prices due to reduced supply.

Shifting Natural Gas Dynamics

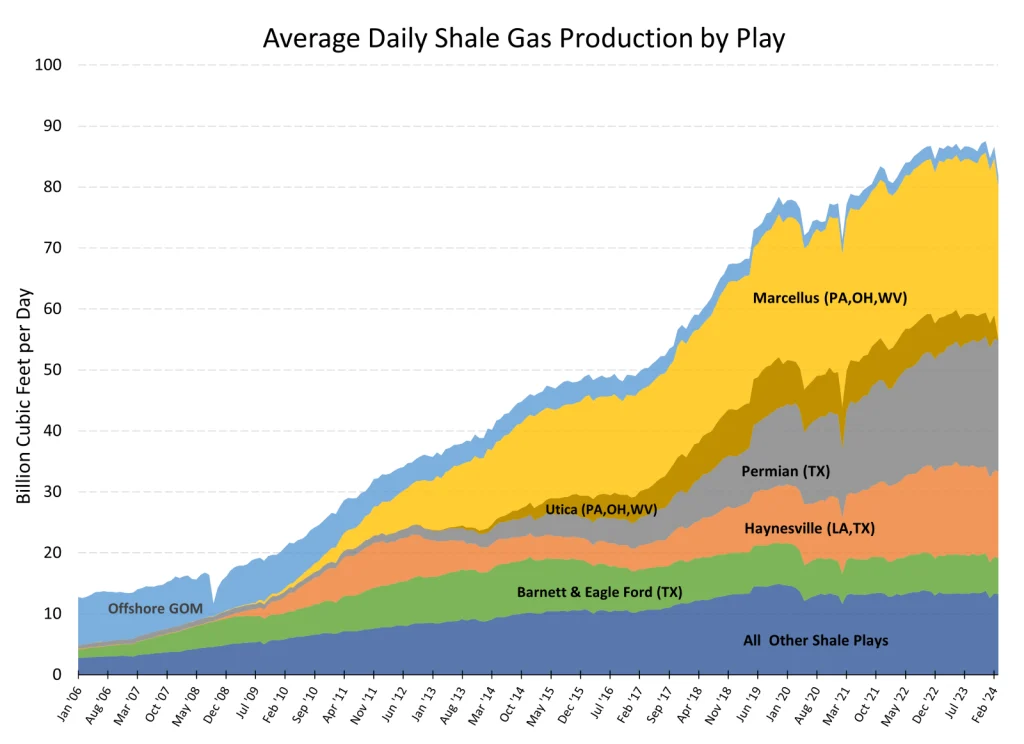

However, as Hurricane Francien approaches, experts believe that the storm’s impact on natural gas prices may be different than in the past. The energy market has undergone significant changes over the past two decades, largely due to the rise of onshore natural gas production through horizontal drilling and hydraulic fracturing. Major reserves in areas like the Marcellus and Utica shale formations in Appalachia, as well as the Permian and Eagle Ford in Texas, have reduced reliance on Gulf of Mexico offshore production.

In 2006, offshore platforms were the primary sources of U.S. natural gas. Today, the majority of domestic gas comes from onshore fields, where production is not as vulnerable to hurricane disruptions. This shift in the natural gas landscape has also altered the impact hurricanes have on energy prices.

Natural Gas Prices and Demand Reduction

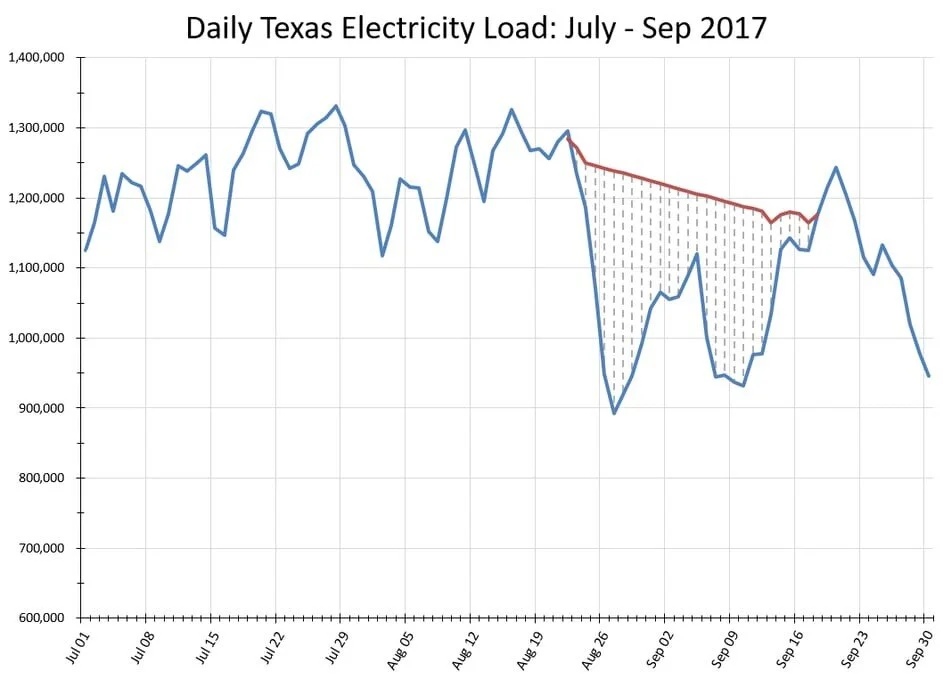

Rather than driving prices higher, major hurricanes now often lead to a temporary reduction in natural gas demand due to widespread power outages. For example, after Hurricane Harvey struck Texas in 2017, electricity usage in the state dropped by 30% in the days following the storm, leading to a significant decrease in natural gas consumption for power generation. Over the weeks that followed, Harvey reduced natural gas demand by approximately 35 billion cubic feet (Bcf) in Texas alone, due to the corresponding reduction in electricity usage.

With the majority of natural gas now sourced from onshore shale formations, hurricanes like Francien are more likely to cause temporary decreases in electricity usage, which could lead to a bearish outlook on natural gas prices. This is particularly relevant in today’s market, where natural gas supply remains robust, and demand drops significantly in the immediate aftermath of a storm.

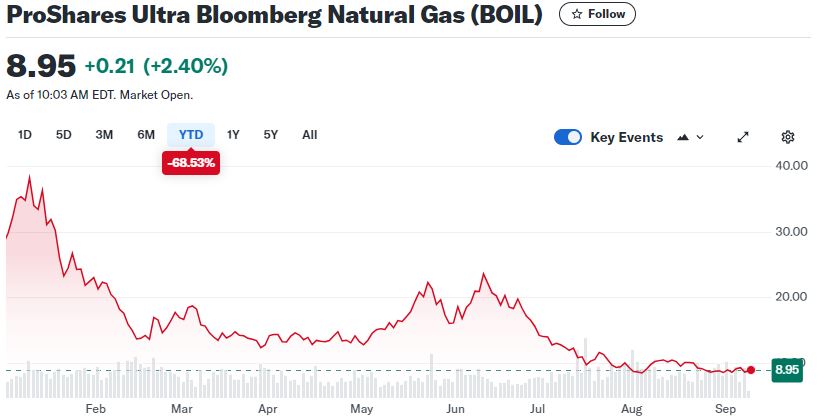

The natural gas ETF Boil may already have the season’s expected high number of hurricanes priced in as major traders generally place their trades at the beginning of the hurricane forecast season.

Looking Ahead

As Hurricane Francien approaches the Gulf Coast, the energy market will be closely monitoring the storm’s path and impact. While Francien may cause short-term disruptions to offshore production, the current dynamics of the natural gas industry—driven largely by abundant onshore reserves—suggest that the storm is more likely to dampen demand than disrupt supply. Consequently, natural gas prices are expected to remain stable or even decrease in the wake of Francien, reflecting a broader trend of declining energy demand in the aftermath of major hurricanes.

For coastal residents, the priority remains safety, and emergency services are urging people in the affected areas to heed evacuation orders and prepare for potential flooding. As the storm intensifies, the NHC continues to issue updates, available at hurricanes.gov.