The latest Consumer Price Index (CPI) report from the Federal Reserve, released on Wednesday, offers some relief: inflation has continued to cool, with prices rising just 0.2% in August and annual inflation now standing at 2.5%, the lowest level since February 2021. Despite the encouraging headline, American households are still feeling the pinch at the grocery store, where food prices, though stabilizing, remain significantly elevated compared to three years ago.

Economists and financial experts have been watching inflation trends closely. While many initially attributed the sharp rise in prices during the pandemic recovery to an overheated economy, others, point to greed or corporate price gouging as a significant driver.

Corporate profits, which reached record highs in 2023, accounted for over 40% of the inflation between the end of 2019 and mid-2022. This suggests that while inflation rates are declining, companies have maintained high profit margins, keeping prices elevated for consumers.

Although grocery prices ticked up by less than 1% over the past year, they remain high compared to pre-pandemic levels. The White House has responded to consumer concerns by cracking down on what it calls “corporate rip-offs,” particularly in the retail and food sectors. Major retailers like Target, Walmart, and fast-food chains such as McDonald’s and Burger King have started offering discounts to keep customers coming through their doors, but these efforts have done little to provide lasting relief for many Americans.

One area where prices have notably declined is online grocery shopping. According to one source, online grocery prices dropped by 3.7% in August compared to July 2024. This marked the largest one-month decline in online grocery prices since at least 2014. However, for the millions of Americans who rely on physical grocery stores, these digital discounts are not enough to alleviate the ongoing strain on household budgets.

In fact, consumer stress is mounting. Reports of rising debt balances and delinquencies signal growing financial pressure. Despite a summer of heavily advertised deals and price cuts, particularly from fast-food chains, consumer market researchers say Americans are pulling back on spending. A report from Morning Consult, which tracks consumer views on pricing and purchases, found that fewer people were surprised by higher-than-expected prices in August. However, this doesn’t mean they’re ready to open their wallets.

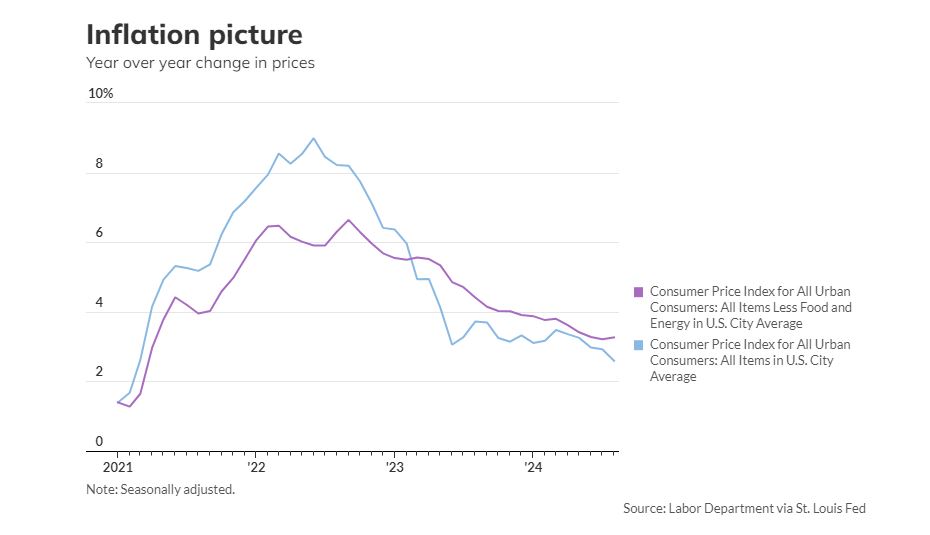

The headline inflation rate of 2.5% marks a significant reduction from the highs of summer 2022, when inflation surged to levels not seen in over 40 years. Yet, the report also revealed that core inflation, which excludes volatile food and energy prices, increased by 0.3% in August, slightly higher than the anticipated 0.2%. The core inflation rate remains at 3.2%, which may keep the Federal Reserve on edge as it continues its fight against inflation.

As the Fed prepares for its next meeting on Sept. 18, traders have priced in an 85% chance of a 25 basis point interest rate reduction. Real earnings have increased, with average hourly earnings outpacing the monthly CPI increase by 0.2%, providing some relief to workers. However, inflation-adjusted hourly earnings have only risen 1.3% over the past year, meaning most Americans still face an uphill battle when it comes to rising costs.

With inflation cooling and signs of a slowing labor market, the Federal Reserve faces a delicate balancing act. Job creation has slowed considerably, nearly halving since April compared to the previous five months. This slowdown has shifted the Fed’s focus: preventing a broader economic downturn is becoming just as important as managing inflation.

While the Fed may signal further rate cuts in the coming months, it’s clear that many households are still grappling with the effects of elevated prices, particularly at the grocery store. The CPI’s headline numbers may indicate that inflation is cooling, but for Americans struggling with persistent grocery bills, financial relief remains elusive.