McDonald’s Global Sales Fall: Newsom’s California Fast Food Minimum Wage Not The Cause

McDonald’s is facing its first global sales decline in over three years, attributed to inflation-weary consumers opting for cheaper options and reducing their dining out habits. CEO Chris Kempczinski highlighted…

Morgan Stanley Names Tesla Top Pick as Starlink and SpaceX Depart California for Texas

Tesla shares surged nearly 6.3% on Monday after Morgan Stanley named it the “top pick” in the U.S. automotive industry, replacing Ford. Despite recent political controversies and strategic relocations of…

Newsom’s California Minimum Wage Hike: Fast Food, Red Lobster, Need New Strategy

California’s recent minimum wage hike to $20 per hour, signed into law by Governor Gavin Newsom, has compelled fast food chains to reassess their pricing strategies. While there was initial…

DeSantis Loses Ground as Disney’s ‘Deadpool & Wolverine’ Smashes Florida Box Office

Disney has scored a significant victory with the release of Marvel Studios’ latest film, “Deadpool & Wolverine,” which broke box office records and surpassed expectations. The film, starring Ryan Reynolds…

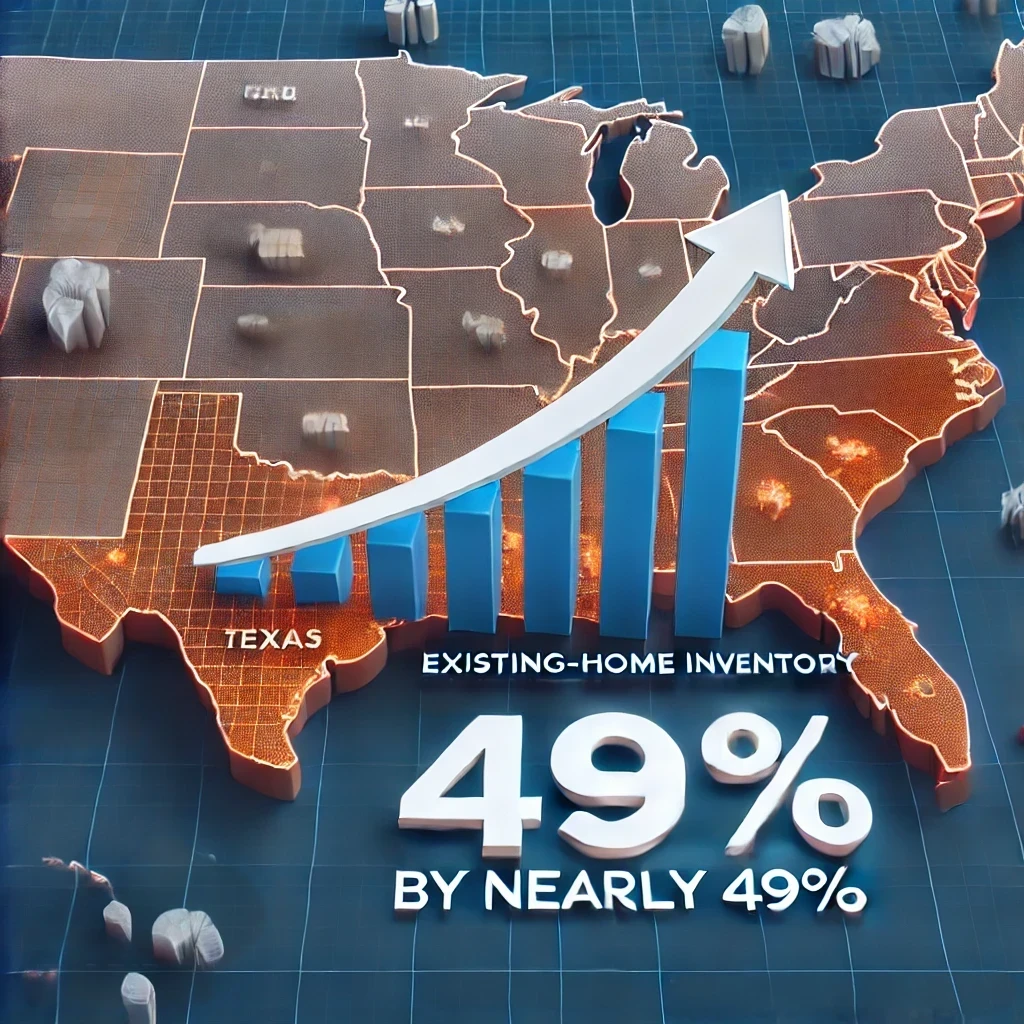

Record High of Unsold New Homes Plagues US South: What’s Behind the Surge?

In the US South, the number of unsold new homes has hit an all-time high, particularly in Florida and Texas. In June, 293,000 newly built houses were still on the…

Florida Condo Crisis Deepens: DeSantis Passes the Buck to Legislators

As condominium owners throughout the state face significant hikes in their homeowner association assessments, Florida Gov. Ron DeSantis said it’s up to the Legislature to convene a special session to…

Ford Stock Plummets 18.4%, Worst Drop Since 2008

Detroit — Ford Motor Company is leading a drop in major U.S. automotive stocks this week because of disappointing results and doubts from investors about future performance. Ford’s shares closed…

McDonald’s $5 Value Meal Extension May Hurt California Franchisees

McDonald’s has decided to extend its popular $5 meal deal through August, a promotion initially set to end in July. This decision follows a strong vote from franchisees, with 93%…

Market Signals: 100% Certainty of Fed Rate Cut by Fall

Traders are now completely sure that the Federal Reserve will lower interest rates by September. According to the CME FedWatch tool, there is a 93.3% chance that the Fed’s target…

Hemp Companies Brace for Major Federal Law Overhaul and Stock Price Impacts

Federal law changes could bring significant impacts to hemp farmers across the United States, affecting their operations and profitability. The recent legislative proposals and amendments aim to modify regulations surrounding…