In recent years, inflation has surged, impacting the cost of living for many people. While several factors contribute to inflation, some argue that its roots can be traced back to the bank bailout of 2008. The financial crisis of that year led to unprecedented measures to stabilize the economy, but these actions may have planted the seeds for the inflation we see today.

In 2008, the global economy faced a severe crisis. Major financial institutions were on the brink of collapse due to risky lending practices and the bursting of the housing bubble. To prevent a complete economic meltdown, governments worldwide intervened with massive bailout packages. In the United States, the Troubled Asset Relief Program (TARP) allocated $700 billion to rescue failing banks.

The primary goal of these bailouts was to restore confidence in the financial system and ensure liquidity. By injecting vast amounts of money into the banking system, the government aimed to encourage lending and investment. However, this influx of money had long-term consequences. The increased money supply, combined with low-interest rates, created a fertile ground for future inflation.

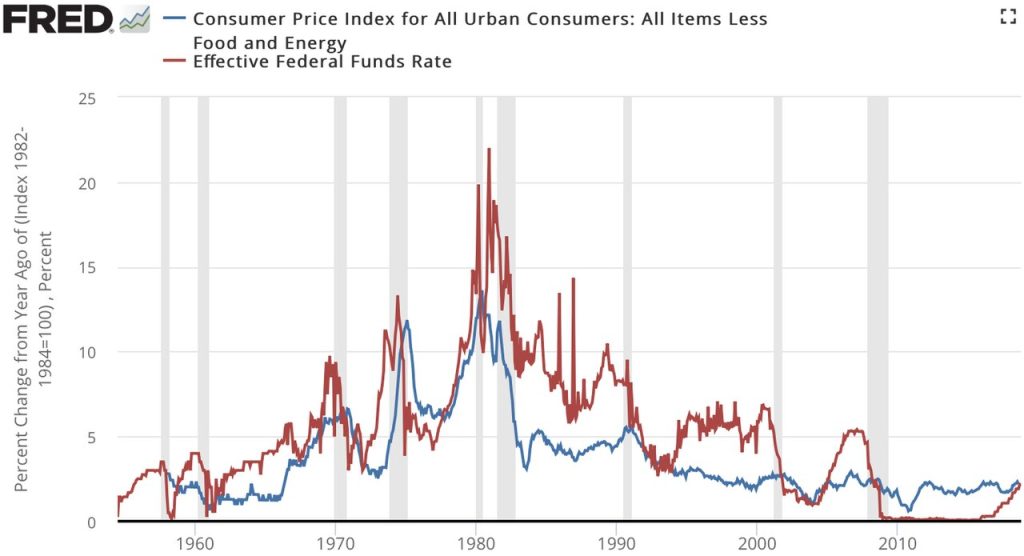

One immediate effect of the bailout was the stabilization of the banking sector. Banks, once teetering on the edge of insolvency, were able to recapitalize and continue operations. However, the bailouts also led to an era of loose monetary policy. The Federal Reserve, in an effort to stimulate the economy, kept interest rates at historically low levels for an extended period. This made borrowing cheap, encouraging spending and investment but also increasing the risk of inflation.

In the years following the crisis, the economy recovered, but the effects of the bailout lingered. The low-interest environment spurred borrowing and spending, contributing to asset price inflation. Housing prices, stock markets, and other assets saw significant increases in value. While this created wealth for some, it also widened the wealth gap and laid the groundwork for inflation in consumer goods.

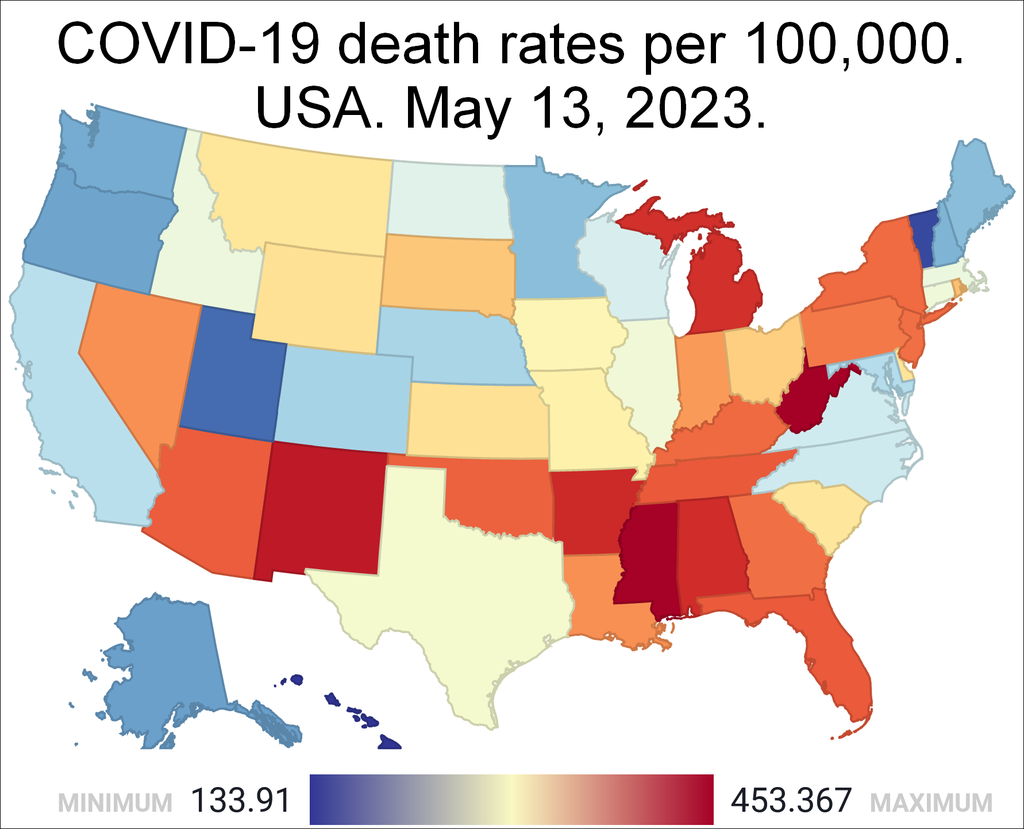

The COVID-19 pandemic further exacerbated these issues. To combat the economic fallout from the pandemic, governments and central banks once again resorted to massive fiscal and monetary interventions. Trillions of dollars were injected into the economy through stimulus checks, unemployment benefits, and business loans. These measures, while necessary to prevent a deeper recession, added to the money supply and increased demand for goods and services.

As the economy began to recover from the pandemic, supply chain disruptions and labor shortages emerged. With more money in circulation and demand outstripping supply, prices began to rise. The inflationary pressures we see today can be linked back to the policies implemented during the financial crisis and the pandemic response.

Critics argue that the bailouts of 2008 set a precedent for government intervention and loose monetary policy. The actions taken to stabilize the economy then created an expectation that central banks would always step in to support the market. This has led to a cycle of increasing debt and money supply, contributing to long-term inflationary pressures.

While the bank bailout of 2008 was necessary to prevent an economic collapse, it had far-reaching consequences. The influx of money into the financial system, combined with prolonged low-interest rates, created conditions that have contributed to the inflation we experience today. The COVID-19 pandemic further amplified these effects, leading to the current economic environment. Understanding this connection helps explain why inflation has become a persistent issue and underscores the importance of cautious monetary and fiscal policies.