Donald Trump’s recent declaration that he plans to hold onto his stock in Trump Media & Technology Group (TMTG) for a “long time” has sparked interest and skepticism. With the stock experiencing volatility and Trump accusing regulators of unfair treatment, his statement appears to be a move to instill confidence in both the company and the market. However, given Trump’s well-known history of making bold claims, investors may wonder what “long time” truly means in this context. Trump’s commitment to holding his shares raises questions about whether this is a genuine long-term strategy or a tactic aimed at stabilizing the stock’s price temporarily.

In response to the falling stock value, Trump made his stance clear, stating, “No, I’m not selling. I’m not leaving. I love it. I think it’s great.” By emphasizing his refusal to sell, Trump aimed to reassure investors that his involvement with the company is unwavering. In a post on Truth Social, he doubled down, saying, “In my opinion, it is THE REAL VOICE OF AMERICA, but it is definitely MY VOICE, and it will be for a long time to come!” This strong rhetoric aligns Trump’s personal and political brand with the future success of TMTG and its platform, Truth Social.

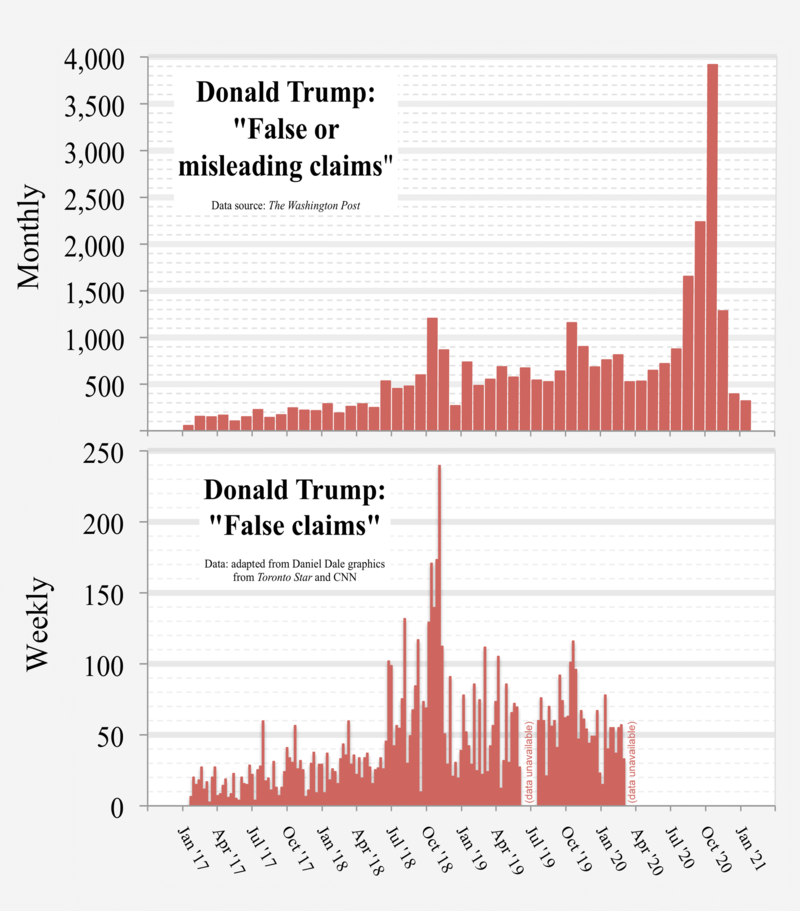

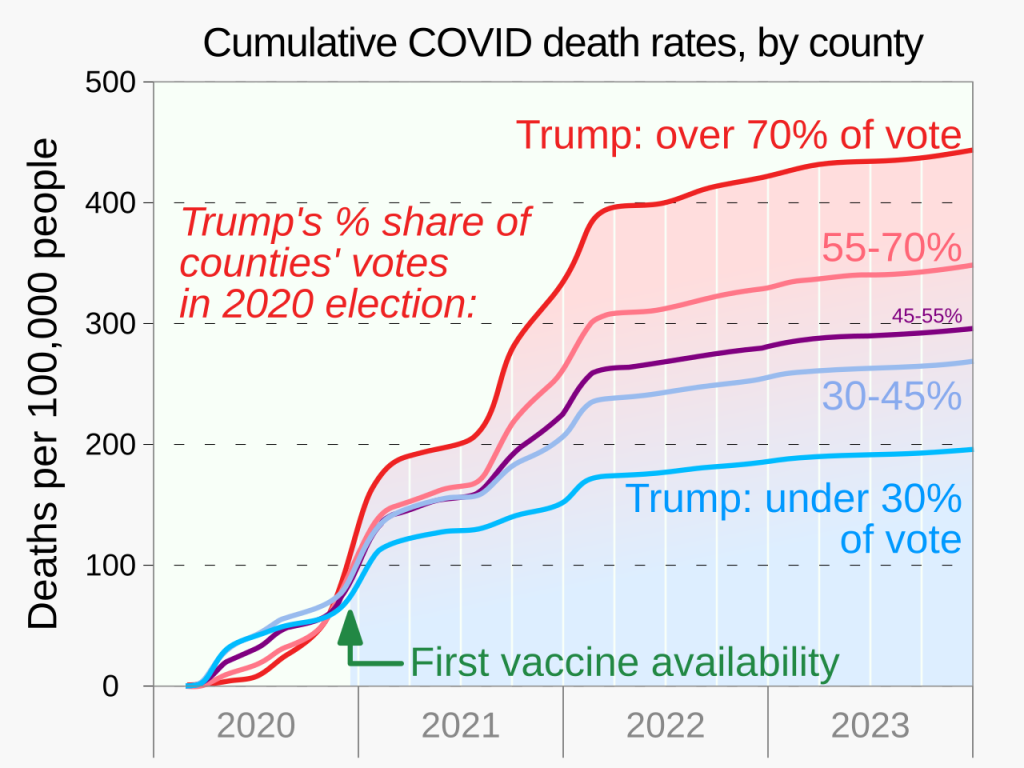

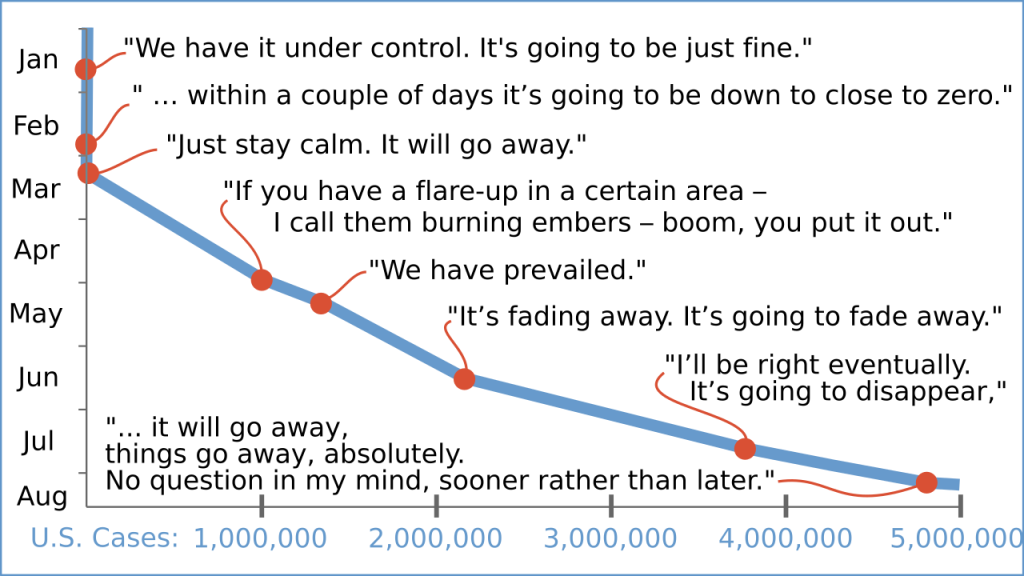

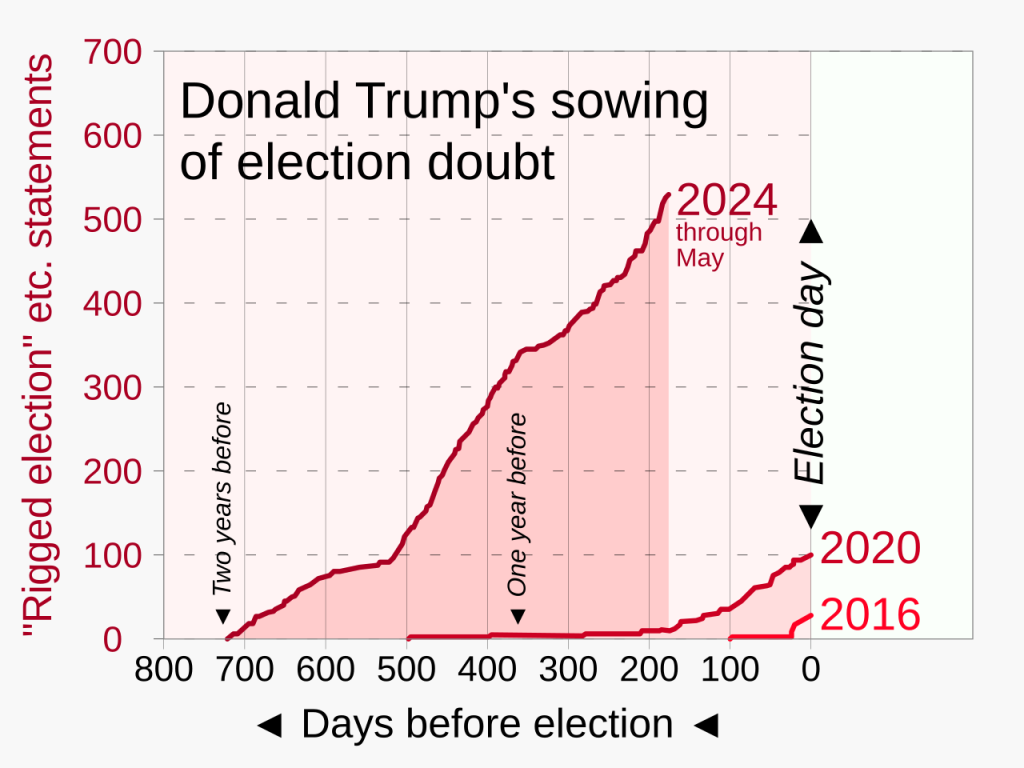

Yet, Trump’s track record of making exaggerated or false claims cannot be overlooked. Throughout his political career, he has often presented information that suits his narrative but doesn’t always hold up under scrutiny. For instance, his repeated false claims about election fraud after the 2020 election and his early downplaying of the COVID-19 pandemic are just two examples where Trump’s public statements didn’t align with reality. This pattern makes it harder to take his words at face value, even when they pertain to his business ventures.

The financial context also raises doubts about Trump’s “long time” promise. According to reports, Trump and other insiders will soon be eligible to sell their shares, opening the possibility of a significant sell-off. While Trump has publicly stated, “No, I’m not selling,” the financial opportunity may prove too tempting to resist, especially if market conditions change. Investors should be cautious, considering the real possibility that Trump’s intentions could shift quickly depending on financial or legal circumstances. Believing Trumps statements in the past has not turned out well for some people.

Trump’s business history reveals a tendency toward opportunism. From his real estate ventures to his political career, Trump has shown a willingness to adapt his strategy when it benefits him personally. His decision to hold or sell his TMTG stock may be driven by similar factors. Investors should remember that “long time” for Trump may not align with a standard long-term investment strategy. Instead, it could reflect his short-term interests, especially if his political or financial goals shift.

Moreover, Trump’s connection of his media company to the idea of being the “REAL VOICE OF AMERICA” blurs the lines between business and politics. His ownership of TMTG is not just a financial asset but also a key part of his personal brand and political influence. This intertwining of business and politics may reinforce his desire to hold onto the stock, but it also leaves room for his strategy to change if political dynamics evolve. Investors need to consider the possibility that Trump’s commitment could waver as circumstances around him shift.

Trump’s ongoing battle with regulatory bodies like Nasdaq and the SEC adds another layer of complexity. After accusing Nasdaq of halting trading on TMTG stock for “political reasons,” Trump hinted at legal action, saying, “I am going to hold NASDAQ, and maybe the SEC, liable for doing what they are doing.” This tension with regulators could further influence his decision-making regarding the stock. If Trump feels that regulatory challenges will continue to affect his company’s potential, his willingness to remain invested “for a long time” may diminish.

The upcoming opportunity for Trump and other insiders to sell their shares could lead to market instability. If Trump sells a significant portion of his stake, it could signal a lack of confidence in TMTG’s future, contradicting his earlier statements. Investors who rely on Trump’s words about a “long time” may find themselves unprepared if the stock suddenly dips as a result of insider sales. It’s important to weigh his public statements against the financial realities he faces.

While Trump’s declaration might seem reassuring to some, it’s crucial to remember his history of making statements that don’t always align with his actions. His financial interests, political motivations, and legal challenges could all impact his future decisions regarding TMTG. Investors should be prepared for the possibility that Trump’s definition of “long time” could change if his personal or financial circumstances shift.

In the end, Trump’s statement about holding onto his stock for a “long time” should be viewed with skepticism. His well-documented tendency to mislead, coupled with the financial opportunities available to him, suggests that “long time” may be more flexible than it appears. Investors would be wise to critically assess Trump’s history of changing strategies and consider the potential for his plans to shift, even after making such bold public claims.

Disclaimer: The Author has no positions in any stock mentioned.